The land beneath – why Magic Millions supremo Gerry Harvey won’t sell

Behind the sales rings of Australasia’s major thoroughbred auction houses sits another asset class altogether, with Inglis, New Zealand Bloodstock and Magic Millions collectively holding land valued at more than $1 billion. While the temptation to cash in looms as urban sprawl closes in, Magic Millions co-owner Gerry Harvey says the company remains committed to selling horses.

One might say that the most valuable asset any of Australasia’s thoroughbred auction houses has is its people.

And that’s true in what is predominantly a relationships business when it comes to the trading of racehorses and breeding stock at live and digital sales.

But Inglis, New Zealand Bloodstock and Magic Millions are also sitting on land worth well north of $1 billion.

The Sir Peter Vela-owned NZB, which has inspections underway ahead of the country’s 100th National Yearling Sale, is located on a large parcel of land on the outskirts of Auckland.

Development has encroached around the facility, which was opened in 1988, such has been the urban sprawl of New Zealand’s biggest city.

But the Vela family to date have remained committed to selling horses at Karaka.

Inglis has its $140 million Sydney base at Warwick Farm, opened in 2018, and Oaklands Junction near Melbourne.

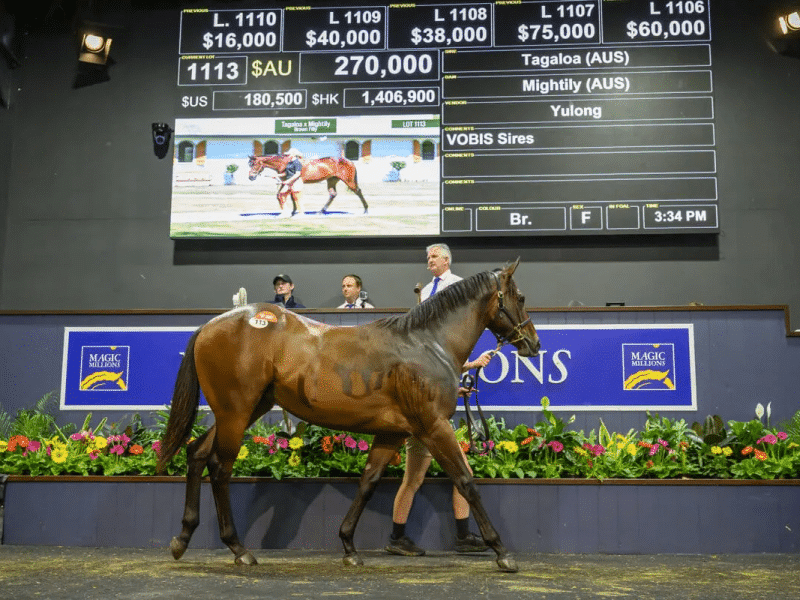

Magic Millions has its prime land on the Gold Coast at Bundall, opposite the turf club, while it also owns sites in Adelaide and in the Swan Valley near Perth.

It could be deemed inflammatory, referencing the failure to sell Sydney’s Rosehill racecourse for $5 billion, a proposal which was rejected in majority by Australian Turf Club members, but for privately owned businesses, the temptation to cash in on the land may well arrive.

In an extended Straight Talk interview, Magic Millions co-owner Gerry Harvey was asked about the large property portfolios associated with his company.

From an outsider’s perspective, the site which hosts the Adelaide Yearling Sale, conducted annually at Harvey’s Magic Millions complex next to Morphettville racecourse, looms as the one most likely to be sold off.

Construction is occurring around the racecourse, and it will cause logistical issues at the South Australian sale in March, but Harvey says for now he remains committed to running an annual auction from the city’s sole racecourse despite developers’ overtures.

“That Adelaide property, I’ve been offered $30 million … (and) I paid $2 million for it, and I’m not selling it. But that doesn’t mean one day I won’t,” Harvey says.

“But then I’d have to find another site and build stables and a complex. I did that in Perth, and if you’ve ever been to Perth in the old days … what a shocking, bloody situation it was.

“The stables were terrible, the whole thing was a shocker, and now we’ve got a really modern, wonderful setup.

“I even had one of the vendors come, and he was crying when he was talking to me. ‘You’ve done this for Western Australia. We want you to know how happy we are’.”

Harvey admits buying a greenfield site to construct a thoroughbred auction complex was more about landbanking, but given the level of investment from West Australian participants in recent years, the Perth sale has been a handy money-spinner.

“I did that on the basis that I’d make no money, but I’d break square. I’m actually making some money,” he says.

“So, that’s the good part about it. I’ve got a block of land that will probably be housing 10, 20, 30 years from now. So, and it’s the same with this block of land here (on the Gold Coast).

“So, that’s a little gold mine in the future, if you like. I’m 86, so I probably won’t be a part of the gold mine, right? But someone will. And this is very valuable land.”

That timeline could be construed as confronting for the industry – 10 years fly by in the breeding game – but Harvey was more reassuring when pressed further on landbanking.

“There’s no plan whatsoever to do anything different. So, you know, from (my wife) Kate’s point of view, she loves this business,” Harvey says.

“You can see what she’s done up here (on the Gold Coast). What she’s done has been extraordinary. I don’t believe anyone else in the country could have done what she did. And it’s been very successful.

“You go out there in that crowd at the moment, you look at it and you think, all those people have got a dream. And so you’re giving someone something to dream about, and if the dream comes to reality, you’ve changed their lives.”

At times, Harvey makes it sound like it’s almost impossible for a thoroughbred auction house to turn a profit by selling horses, but that’s not quite the case.

Magic Millions is making money, it’s just much harder to do it than it is through Harvey’s publicly listed retailer Harvey Norman.

Harvey has been the retail king for decades, making a fortune ($3.82 billion with his wife, Katie Page, according to the Australian Financial Review 2025 Rich List) by selling fridges, televisions and vacuum cleaners.

“And I love it. It’s Harvey Norman. We’re in eight countries, we employ 20,000 people, and we’ve got over 300 shops,” he says in a meeting room on the last of four Book 1 selling sessions on the Gold Coast.

“It’s interesting, but in a way, this (racing and breeding) is more interesting. It’s an animal, it’s a horse race, it’s very competitive, and it’s bloody hard to make money out of it.”

It’s that passion for the industry alluded to by Harvey, which has also driven the Inglis family to continue to sell horses at their purpose-built complexes at Riverside Stables in Sydney and Oaklands Junction in Melbourne.

Inglis parted with its Newmarket sales complex near Randwick racecourse and built a facility that included a hotel adjacent to Warwick Farm racecourse.

The upstairs bar at the William Inglis hotel is named 1867, a nod to the year the company began,

They have also diversified into twice-monthly digital thoroughbred sales, which have provided the market with significant liquidity and Inglis with year-round cash flow. Inglis Digital exceeded $95 million in turnover last calendar year.

“Inglis sold their land in the eastern suburbs. It’s now worth probably three times what they sold it for (reportedly $250 million),” Harvey says of his rival’s move to southwest Sydney.

“They should have waited until now. But, you know, they’ve got a successful operation out there near Liverpool.”

NZB, too, has diversified its business, taking on the standardbred auctions, operating the online auction house Gavelhouse, and, following Inglis’ lead, building a hotel at Karaka.