Drop in racing turnover drags on Tabcorp

A host of wagering companies have reported the challenges of dropping turnover in racing over the past 12 months, as the sport comes off pandemic-era highs in interest and investment.

Tabcorp released its financial results for the first half of the 2023-24 financial year on Thursday and lodged a $637 million net loss in the first half of the financial year, a result significantly impacted by a $732 million impairment charge.

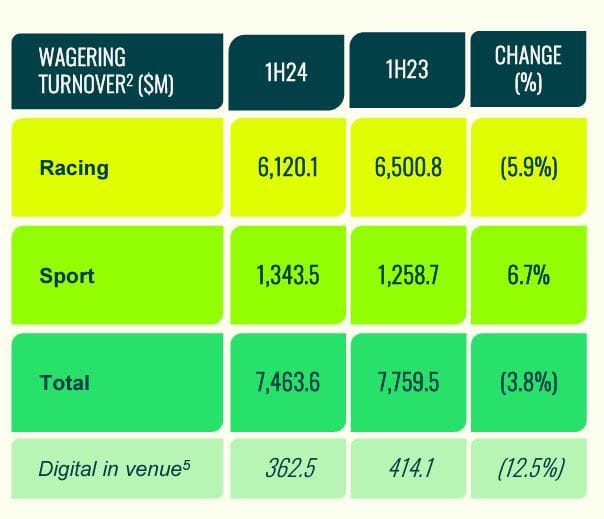

However, the devil was in the detail when it came to the racing industry, with Tabcorp revealing year-on-year racing turnover had dropped from $6.5 billion to $6.12 billion, some 5.9 per cent.

While sports betting turnover increased 6.7 per cent, up from $1.26 billion to $1.34 billion, Tabcorp reported overall wagering turnover fell 3.8 per cent compared to the second half of 2022.

Interestingly, Tabcorp did report that its share of racing turnover had increased, which means that it fared better in terms of its racing business in that metric than its competitors over the same period.

While the top-line number in the first half results was red, Tabcorp CEO Adam Rytenskild said that the transformation goals put in place through the TAB25 strategy were coming to fruition and the overall outlook for the company was positive.

“Tabcorp’s transformation is on track,” he said.

“TAB’s improving market share trend highlights this, and the broader operational result demonstrates the substantial progress we have made as a company.”

Rytenskild also praised the 20-year deal Tabcorp struck with the Victorian government in December to continue its retail and parimutuel exclusive licence, which is due to begin in August 2024.

He said that deal, which ends the long-term joint venture with the government, would transform Victoria from being Tabcorp’s lowest margin state to its highest.

“It was a very exciting and terrific way to end the half,” Rytenskild said. ”I can’t emphasise enough how this licence will transform our business.

“It has strong retail protections and significantly higher margins for Tabcorp. Had the licence been in place last financial year, our EBITDA would have been $140 million higher.”

Rytsenskild confirmed that Tabcorp intended to fund its $600 million investment in the Victorian licence, which is due to be paid by June, from existing debt capacity.

The $732 million impairment charge, which pulled Tabcorp into deficit, was largely driven by the company’s wagering businesses in NSW and South Australia, the two states where it says it does not operate on a level playing field with its competitors.

It attributed this impairment to the softness of the Australian wagering market as well as its specific deals in those states.

“I think six to 12 months ago, everyone was enjoying the highs of post-COVID and the growth rates that we were seeing,” Tabcorp CFO Damien Johnston said. “Effectively we have seen a bit of a correction in this half which was not as evident six to 12 months ago.”

“While we are all confident that there is a long-term growth story in a resilient category, I think the reality is that the macro factors have lowered the expectations today and have lowered the starting point going forward.”

Tabcorp said it would continue to seek licence reform in NSW and SA to achieve better terms. That comes after the recent revelation that Racing NSW was taking Tabcorp to court over the terms of the long-term deal between the two.

Rytenskild said he had every confidence that wagering would return to growth in the 2024-25 financial year and Tabcorp was well positioned to take advantage of that, particularly with the new Victorian deal set to begin and a new deal with Queensland in operation.

Tabcorp anticipated that growth would be around 2-3 per cent mark across wagering.

Tabcorp’s half-year results come in the same week the company announced a sponsorship and media rights deal with the VRC for the next six years, while it was also involved in brokering the free-to-air broadcast rights with the Nine Network.

“We think the combination of the VRC and the new TAB retail licence in Victoria is very strong and is going to set us up in Victoria over the next era,” Rytenskild said.

Tabcorp shares dropped from 73 cents to 64 cents in the first hour of trading on Thursday.