‘A huge opportunity’ – Can racing rise on the back of the global crypto surge?

A natural overlap between those who bet on racing and those who invest in cryptocurrency represents a major opportunity for the emerging crypto casino and sport betting platforms to capitalise on the racing industry.

That’s the view of Ishan Haque, the Australian-based executive of crypto betting platform Shuffle, who sees the potential for these global platforms to dominate all aspects of the wagering industry, including racing.

Haque recently spoke on a webinar conducted by Waterhouse VC, the wagering industry focused venture capital firm led by former bookmaker Tom Waterhouse, where the scope of the crypto casino market was discussed.

It is predicted the unregulated global market under which many of these relatively new crypto-betting operators currently exist will be worth up to US$210 billion in gross gaming revenue by 2030, 36 per cent of the overall global total addressable market when it comes to wagering.

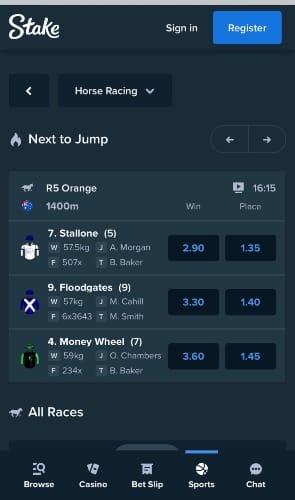

Australian-owned but Curacao licensed Stake.com is the market leader, with Haque estimating it is 10 times larger than their nearest rivals in the space.

But a host of operators have emerged, including Shuffle, founded last year by Noah Dummett, working closely with Haque. Like Stake, it is Melbourne-based and licensed in the Caribbean island of Curacao.

Asked about the potential for crypto-based operators to tap into the racing market, Haque said there was definitely an opportunity there.

“I do think there’s an overlap between people who historically love racing and the crypto in terms of the appetite, high frequency, that type of betting,” Haque said.

“I do think there’s some overlap there. And I will say there’s probably also another large opportunity.

“Crypto operators historically haven’t offered great sports betting products in general. It’s always been casino-first. I still look at, you know, the Aus bookies and some of the products from the traditional space.”

Stake, which isn’t licensed to operate in Australia, stepped into the racing space earlier this year after a deal with Racing and Sports to provide data and other integrated services. They offer markets to their global audience.

“I do think there’s an overlap between people who historically love racing and the crypto in terms of the appetite, high frequency, that type of betting,” – Ishan Haque

Haque said deals like that signed by Stake and Racing and Sports are just the start of crypto betting sites looking to offer more comprehensive products.

“We’re still building towards a good just general sports betting product. And so on that side, I think there’s still a huge opportunity,” he said.

“We’re all chasing to create the best product in each vertical, you know, casino, sportsbook, lottery. But yeah, that is probably one where a lot of crypto casinos lack in.

“There’s probably some overlap there. I see a lot of opportunities in that space. And no one’s really got it completely right yet.”

Stake is gradually moving away from unregulated into more regulated markets through local licences in various countries.

Waterhouse has said previously that he believed racing has a logical potential for these new operators. An avid supporter of it as a betting product, he told the webinar that there is a major role for racing to play.

“It’s a terrific product in that you’ve got high margin, you’ve got high frequency. And, really, until Stake took the racing part for racing and sports, crypto operators focused on casino-first and then sportsbook,” he said.

“That makes a lot of sense because racing’s really had a stronghold in jurisdictions that do not have online gaming. But I think racing globally has a big role to play because, well, it’s a great product. It’s interesting. It’s got a high skill level.”

Aushorse Investor’s Guide 2025

A compelling case to get involved in Australian racing and breeding

He said much like the crypto ecosystem, understanding betting on racing required some experience and time but was ultimately highly engaging.

“It’s very sticky once you get into it,” he said.

“But also, it’s very attractive for the operator because if they can get their customers on that product offering, it’s generally very high margin.

“I think it’s I think it’s going to be very interesting how it progresses for them once they have the full suite.”

Like Haque, Waterhouse believes that the major global operators will look to offer all avenues of gambling on their platforms.

“They are going to have the best casino product, the best sportsbook product and the best racing product. Now, whether racing is 70 percent of the wagering dollar like it is in Australia, well, that probably won’t be right for crypto casinos. But it only has to be a small percentage of this huge pie globally,” he said.

“It’s a huge benefit to the racing industry in race fields and all the other fees that come through that.”

Australian law introduced this year has banned the use of credit cards and cryptocurrency to fund betting accounts. However, legislative changes in the United States could pave the way for much wider acceptance of cryptocurrency to transact and trade.

The election of Donald Trump as the next US President promised further reform, while Bitcoin, the most high-profile cryptocurrency, has surged beyond US$100,000.

Trump said last week he would consider introducing a strategic “crypto reserve”.

Waterhouse sees strong parallels between the current boom in crypto wagering and the path regulated gambling on racing and sports took in Australia.

“To give you context, there’s 130 online bookmakers in the Australian market with high taxes, high friction, and so on. Back when there was less friction before the TAB came in, there were 6,000 SP bookies in just New South Wales,” he said.

“There were 400 bookies at Randwick every Saturday, let alone all the other tracks around New South Wales.

“We believe with less friction and the ability to get up and going very quickly, there’s a huge opportunity for a long tail of these followers trying to emulate the success of Shuffle and Stake and so on.”