Australia’s online gamblers increase, as both racing and sports bettors jump

The number of Australians who gamble online has grown, with an Australian Communications and Media Authority (ACMA) survey indicating it stands at 36 per cent, with an increase in both racing and sports betting.

The eighth annual ‘How We Use The Internet’ report was published this week featuring data collected up until June 2024. The survey covered the digital habits of around 3300 Australians.

The ACMA report revealed that 99 per cent of Australians had gone online to utilise an internet service in the past six months, up from 90 per cent five years ago with 95 per cent of adults use mobile phones to access the internet.

While there were declines in accessing news and information, accessing government services using an app, video conferencing and calling, the percentage of Australians gambling online has increased from 32 per cent in 2023 to 36 per cent in 2024.

The report had a specific section focusing on online gambling, which has been in sharp political focus through 2024 as the federal government considers changes to gambling advertising laws.

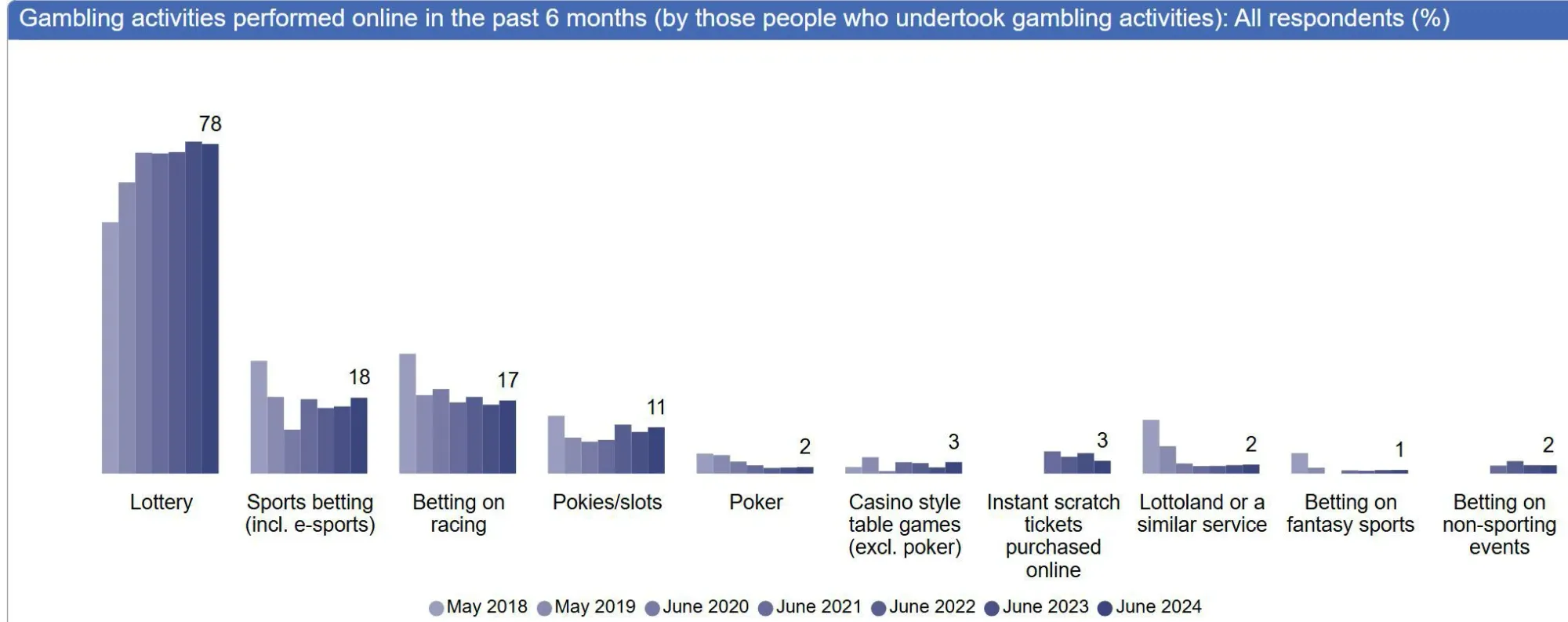

Lottery remained the dominant avenue of online gambling, with 78 per cent of those who gamble online having accessed those services in the past six months. That was steady on what was reported in 2023.

Sports betting is the second most common avenue for online gambling with 18 per cent of those adults who gamble utilising digital avenues to access sports betting services.

In the June 2020 survey, that number was only 10.5 per cent, but that number leapt to 17.7 per cent the following year and has remained at similar levels ever since.

Online gambling on racing had declined slightly in the three years up until 2023, when it stood at 16 per cent. But it rebounded in the latest data, to 18.1 per cent, its highest level since 2019.

According to the survey, 11 per cent of people accessed pokies or slots online, despite this service being blocked to Australians under the Interactive Gambling Act. It’s a similar story for online poker, which attracted 2 per cent of gamblers, as online casino games, which are at 3 per cent.

Regarding age brackets, the survey reported a significant jump in 18-25-year-olds accessing lotteries (64 per cent of those who gamble), as well as online pokies, which has increased to 28 per cent.

Sports betting in that age group was at 32 per cent of those who gamble, while racing in the 18-24 was at a recent low point of 10 per cent.

The online racing percentage jumps to 18 per cent of 25-34-year-olds, before dropping back again, while the 55-64 and 65-74 bracket are the most engaged at 21 per cent.

There was a significant gender differential in those who bet, with 23 per cent of those men who gamble online betting on racing compared with just 11 per cent of women.

The percentage difference was quite similar when it came to sports betting 23 per cent of men compared to 12 per cent of women.

This result was likely impacted by the higher percentage of women online gamblers who had used lotteries, 84 per cent to 75 per cent of men.

Another interesting differential was the fact that 19 per cent of regional online gamblers had bet on racing, while that number was 17 per cent for metropolitan gamblers surveyed.

The result for sports betting was the opposite, 17 per cent for regional and 19 per cent for metropolitan.

The major online wagering operators in Australia have reported turnover has declined 10 per cent in each of the past three years. But in what would be consistent with the above data, they said the number of active players has been the same.

This has coincided with a time when the number of free bets and other incentives has dropped significantly as the major betting companies have wound back their marketing and focussed on growing customer yield.