Could in-running betting help turn the tide?

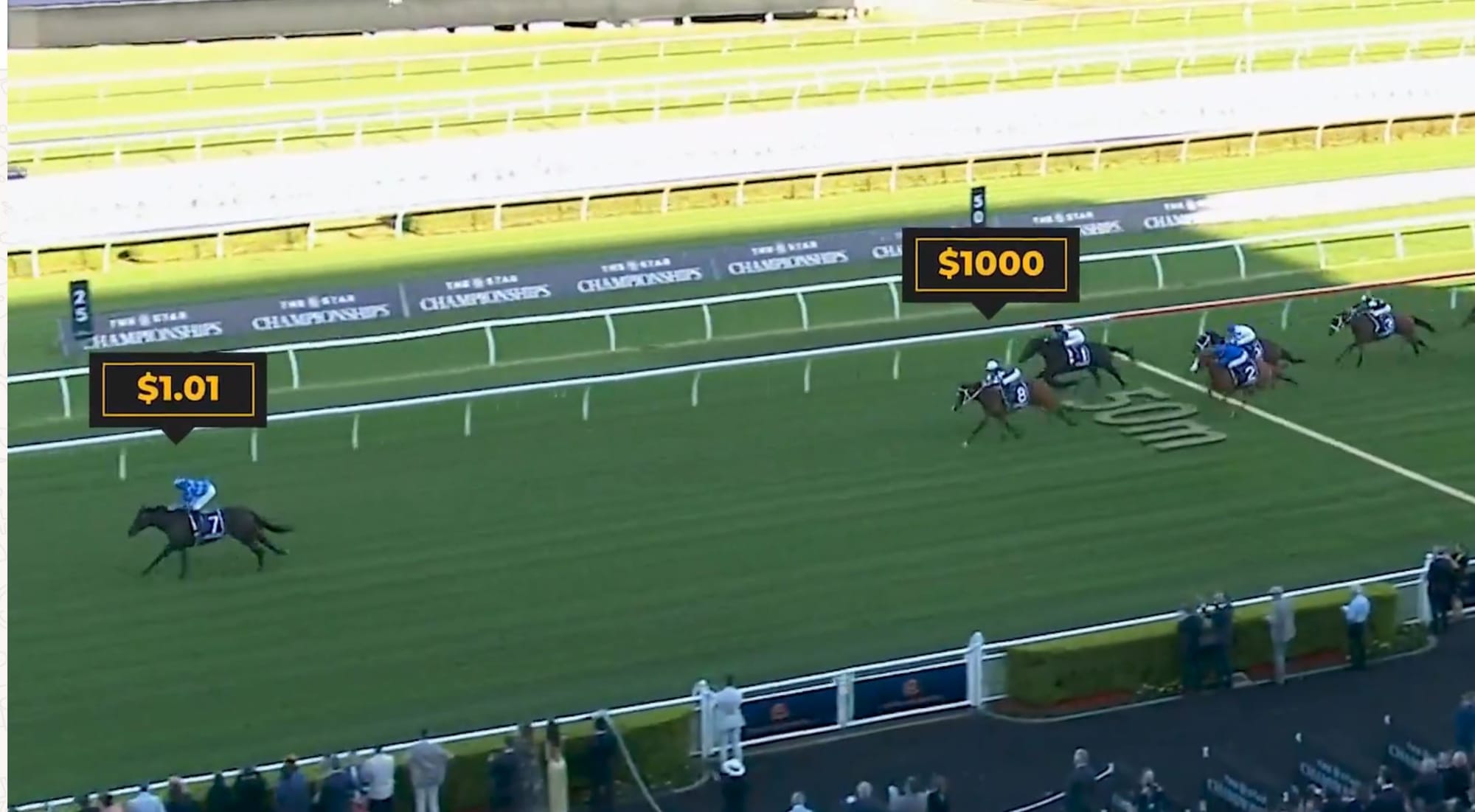

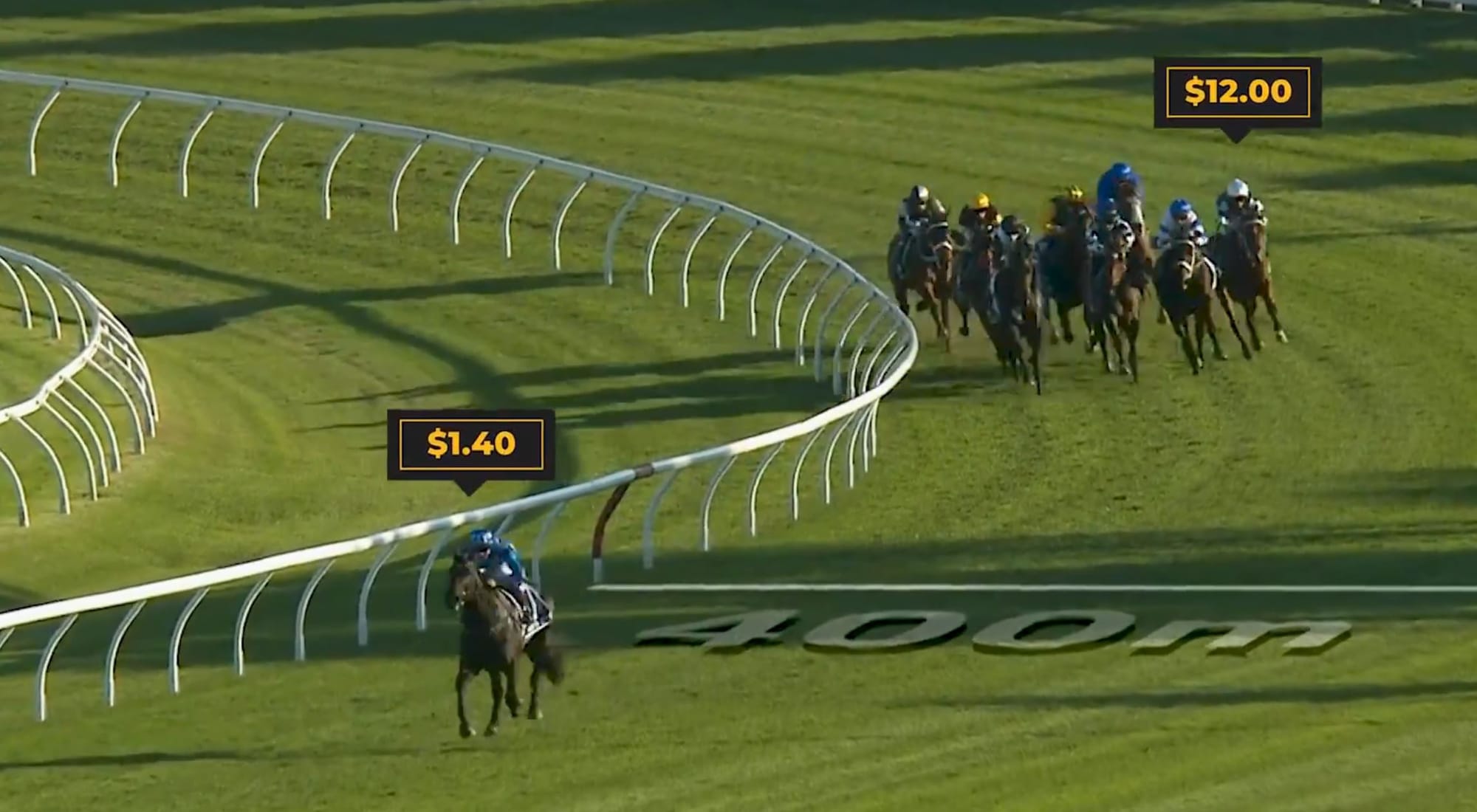

After Pride Of Jenni’s spectacular all-the-way win in the Queen Elizabeth Stakes last Saturday, betting exchange Betfair produced a fascinating video which plotted the odds variations for the front-running mare and her chief rival Via Sistina throughout the race.

As she sailed through the 1000m mark at Randwick, some 30 lengths clear of her rivals, the Betfair exchange still had her at $5, while Via Sistina, half a suburb adrift, was $2.20.

Almost unbelievably at the 600m mark, just after Darren Flindell had proclaimed he “had never seen a horse so far in front in a Group 1”, Via Sistina was still ruling favourite on the exchange, $2.57 to Pride Of Jenni’s $2.80.

By the 400m mark Pride Of Jenni has shortened into $1.57, Via Sistina drifted to $9.60 and it played out how you’d expect from that point.

Aside from being an excellent piece of social media promotion from the Betfair team, it also demonstrated the intrigue of an in-play market, especially in a race over a distance which allows for significant fluctuations, and the opportunity to back a horse after it has jumped.

The current market for in-play betting in Australia is relatively limited. For the exchange, on a race of the right nature it can represent up to 10 per cent of the total market.

The instantly changing nature of in-running betting is naturally suited to the exchange where punters determine the price they are willing to take or offer, depending on which side of the leger they sit. In order to provide any real value, it requires liquidity to ensure the market is worth betting into.

Generational win in the QE

How did the Betfair punters respond to a tearaway Pride of Jenni and Via Sistina 30 lengths behind? pic.twitter.com/dkhgMKnBH1

— Betfair Australia (@Betfair_Aus) April 15, 2024

Corporate bookmakers in Australia also offer in-running betting, but typically only on selected runners, usually three or four, with a ‘rest of field’ option thrown in. Anecdotally, it is usually the domain of those who may miss backing a horse before the jump and opt to take lesser odds when the live market is activated.

Live racing markets contribute less than 5 per cent of overall turnover on thoroughbred racing for corporate bookmakers, although it is probably double that for harness racing, where racing position is much more important to determining the result.

However, a recent announcement by TripleSdata (tSd) and Racing Victoria could provide a boost to the amount of turnover generated “in-running”.

The low-profile announcement was about a partnership between the data company and the Principal Racing Authority to “integrate live race tracking content into Total Performance Data’s (TPDs) live odds engine”.

What does this actually mean? Well essentially tSd and TPD, who recently merged, will licence data from Racing Victoria which will be used to generate fully automated in-running odds feeds for corporate bookmakers to use.

This would, in theory, give corporate bookmakers the ability to offer full field odds for longer during a race, rather than just the three or four plus “other” option they put forward.

It would, again in theory, put them on the same playing field as the exchange and offer greater opportunity for betting in the run.

The data licence, which includes live sectionals and positioning, will be made available for the four metropolitan tracks in Victoria, Flemington, Moonee Valley, Caulfield and Sandown, plus Pakenham and Cranbourne.

The media release points out that the technology is already used by bookmakers in the US, Canada and the UK.

With so much Australian racing taking place over shorter distances, and the drop in prominence of jumps racing over the past 20 years, the value of in-play betting in Australia is no doubt less than it would be in somewhere like the UK or Ireland.

However, the arrival of low-latency video feeds, as has now happened through the TAB app, does put the punter at home in a better position. Previously vision feeds have been significantly delayed, sometimes by up to 10 seconds, and fast fingers were needed to get on at the right price.

Conversely, those at the track were at an advantage seeing the race live but needed the connectivity to make a worthwhile investment.

The delay on vision feeds now is negligible, meaning those watching from afar can have some confidence they are not betting on an event that happened several seconds earlier. Transparency on those delays would be important to punter confidence.

The question is, will the corporate bookmakers embrace the opportunity? Automated feeds are a risk they have to weigh up given manual checking is not really feasible if the odds are changing constantly. That is not a problem with a peer-to-peer set-up like a betting exchange.

However, there is genuine opportunity for greater engagement and greater turnover. Using the basic information that 10 per cent of money on the exchange is bet in running, and that figure is less than 5 per cent for corporate bookmakers, then there is clearly an upside to embrace it as a genuine betting product.

The opportunity is there for punters to not only test their wits in the heat of battle, but effectively trade in and out of positions, creating a more dynamic market, assuming the percentages stack up.

Racing bodies should be encouraging this form of wagering. There will be integrity questions raised, but monitoring and reporting of customer behaviour is sophisticated.

It is also an area which gives racing an advantage over sports betting. Current law prevents online live betting on sport, it is phone only, but that is not a restriction placed on racing. In a competitive betting landscape, every edge is crucial.

Every corporate bookmaker has reported that wagering on racing has declined significantly over the past 12 months. That, coupled with a rising tide of regulation and taxation, puts a challenge on racing’s ongoing funding model.

A resolution requires out-of-the-box thinking and a multi-faceted approach. In-running betting is unlikely to be a silver bullet, but if the benefits outweigh the challenges, then the market and the industry should embrace it.