The opportunity of being first-to-market has been part of Magic Millions’ DNA as a sales company since it held its first January Gold Coast auction in 1987.

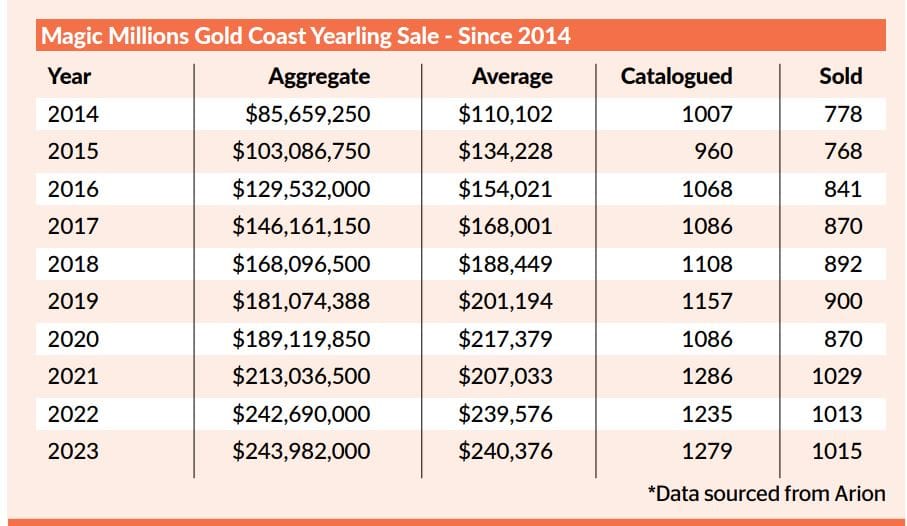

The chance to not only get first access to buyers but also the best stock from vendors has allowed the sale to grow at an extraordinary rate, especially in more recent times. The sale aggregate has increased every year for the past 11 years and the sale average has grown with each edition bar one over the past decade.

So when Magic Millions confirmed off the back of that growth that it would present a record-sized catalogue of 1468 yearlings in 2024, a nearly 15 per cent jump on what it was in 2023, it prompted a few key questions.

Was the Gold Coast-based sales company expanding to capture a greater share of the market, capitalising on that ‘first-to-market’ opportunity to get the cash from buyers, or was it simply responding to market demand from vendors who wanted to get their best product in front of the buyers?

Magic Millions managing director Barry Bowditch is approaching his sixth January sale in charge, having taken over from Vin Cox ahead of the 2019 edition.

In that time, he has seen the sale aggregate across both books grow by 35 per cent, from $181 million in 2019 to $244 million last year. The sale average has increased 19.5 per cent over the same period, first breaking through the $200,000 mark at his first January sale and growing to $240,376 last year.

Bowditch said the increase in catalogue size was not the result of Magic Millions dropping its lofty standards to get more horses to market earlier.

“We didn’t change our threshold on the quality of horse we took for the sale, if anything we increased it. We just had more horses that met that brief and more vendors, when we sent our acceptances out, that were willing to take up the spots we provided them with,” he said.

“I think it’s clear that vendors want to sell early. The results out of this sale year in, year out, get stronger and stronger. Vendors can come here and think it is a viable place to sell their horses, and off the back of that, in terms of the graduate success on the racetrack, no sale compares.

“It makes that decision easy for vendors, to take up the spots that we provided them with and therefore, we ended up with a larger catalogue.”

Magic Millions Gold Coast Yearling Sale - Since 2014

Put simply, Bowditch believes that success begets success. The fact that the average horse on the Gold Coast in January fetched 118 per cent more in 2023 than it did in 2014 makes it compelling for vendors to take their horses there.

“I think because this is a very successful sale to sell at, vendors are very happy to give us their best product. If their best product is ready to go early, they will sell it here in January,” he said.

“When you have good results out of the sale, it gives you a better chance to get the best horses that get sold each year.”

Quality, when it comes to yearlings, can be measured by a few different factors. The most obvious upon release of the catalogue, is pedigree. It is also the most immediately quantifiable, given you can count the number of horses by top sires, out of stakes-winning mares or related to stakes-winning horses.

On at least one of those criteria, the 2024 catalogue is equal to the best-ever for Magic Millions. There are 33 lots by Group 1-winning mares, 10 more than there were last year, and equal to the 2019 catalogue.

There are 33 siblings to Group 1 winners, again historically high, although not as many as the 2018 and 2020 sales, when that number stood at 39.

On the sire side, there are 101 yearlings by the two dominant stallions of the past decade, I Am Invincible (50) and Snitzel (51), representing 37 per cent of their 2022 foal crop.

But the true measure of the quality of the sale is not in the catalogue, or the post-sale results. It comes in the years ahead on the racetrack, and it is in that regard where the success of Magic Millions’ marquee sale is on the rise.

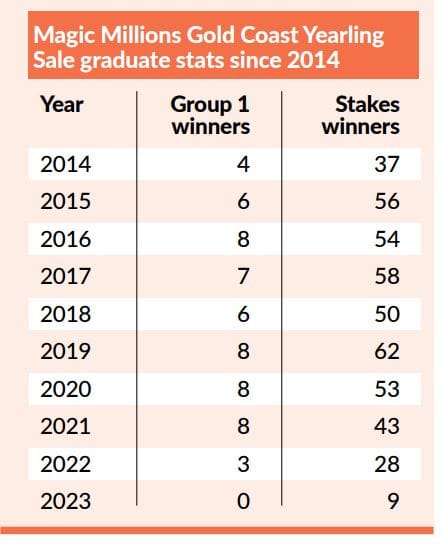

There have been 58 Group 1-winning graduates from the sale since 2014, among 450 stakes winners. That volume of stakes winners has grown from 37 at the 2014 sale, to a peak of 62 from the 2019 edition, while eight Group 1 winners emerged from each of the 2019, 2020 and 2021 sales.

As the biggest yearling sale in terms of size in Australia, it is not surprising that these statistics put Magic Millions at the vanguard in terms of quantity of stakes winners.

But, in Bowditch’s time since 2019, the January sale has also been the leading yearling sale in Australia when it comes to the stakes-winners-to-runners rate, at 5.3 per cent.

“When buyers come here and invest heavily in your product, you want to see them succeed on the track, whether it be internationally or here locally,” Bowditch said.

“I think this sale stands well above any sale you can compare it with. We obviously sell more horses, but when you break it down by percentages, you are twice as likely to buy a Group 1 winner here. The prize money they make per horse is also very, very good.”

While prize money in general has boomed in Australia in the past decade, a key part of that return on investment for buyers is also the Magic Millions Race Series.

“We also have one of the best incentives in the world, from a sales company, given that the race series is worth $20 million, with $14.25 million on one raceday,” Bowditch said.

“We have to make it viable. It’s all well and good selling horses for a lot of money, but we need to make sure we are putting money back in our clients’ pockets. That is what the race series was about."

“I think this sale stands well above any sale you can compare it with." - Barry Bowditch

Sustaining such high standards while growing the footprint of the sale in terms of horses is Magic Millions' biggest challenge. Success may bring success, but it also brings expectations.

Catalogue size is a delicate balance, and there are plenty of examples where the supply has exceeded demand and vendors were left either with horses they couldn’t sell, or having to sell them at a price much lower than they would have hoped.

The first sale of the year often sets the tone for the rest of the season, although 2023 proved somewhat of an exception, with a strong market on the Gold Coast giving way to a more considered level of investment as the year wore on.

The post-pandemic bubble of the broader economy, something that the bloodstock industry was very much a part of, deflated, with rising interest rates and cost of living pressures taking their toll on discretionary investment.

Moving into 2024, Bowditch feels there is more certainty about where the economy is headed and he thinks that should imbue some confidence into the bloodstock market.

“I think coming into this year we probably have a little bit more stability in the economic climate and the sales overseas have held up really well,” he said.

“We have a currency that provides most of the world a reason to invest here and we’ve got a racing product here that, prize money wise, and the vibrancy of our business, gives a lot of confidence to our market leading into Tuesday.”

Bowditch’s own measures of success are pretty clear. When he sits back down at his desk after a busy seven days of selling, he is looking to the vendors to tell him what went right and what didn’t.

“I want a healthy market to be honest. I want our vendors to walk away pleased with what they have got from the marketplace. We can’t value the horses for the buyers, but we want to give our vendors the best opportunity to sell their horses,” he said.

“We have been at a 90 per cent clearance rate for the last five or six years here in January. I think our vendors come here knowing they can put their horses on the market and do extremely well.”

Again, it comes back to that balance between meeting the market and vendors getting what they need to prosper.

“They don’t have to set salubrious reserves, the market works itself out and that’s proven by the fact that year on year we have had that high clearance rate,” Bowditch said.