Funding ‘top-ups’ for under-pressure ATC as wagering woes hit home

The Australian Turf Club has posted a $2.4 million operating loss for 2023/24 amid fears of ongoing financial pain with concern its wagering funding model is under threat.

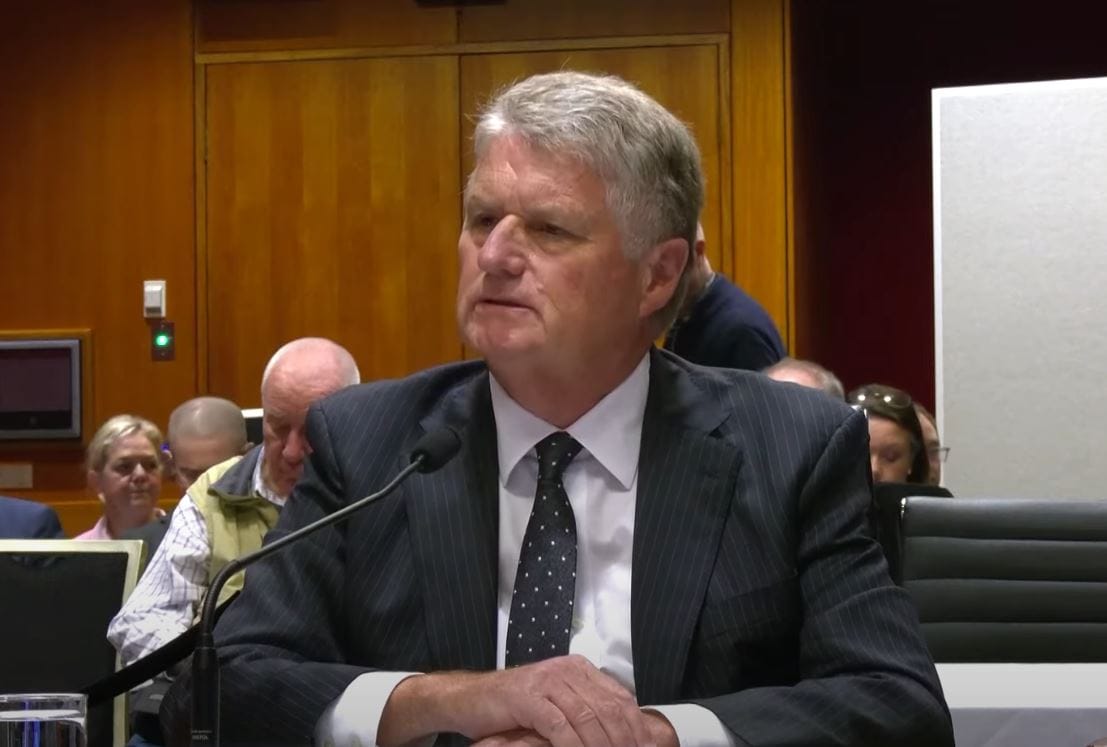

The club reported an overall profit of $512,000 across the year, but the operating deficit and the challenges in the wagering market have chairman Peter McGauran apprehensive about future funding outcomes.

Ahead of a members’ vote to fill two vacancies on the ATC board, McGauran warned the club’s finances will be further strained if wagering revenue continues to fall.

He said more than 60 per cent of the ATC’s revenue is generated from wagering turnover and in 2020/21 the principal club received a record $89.6 million from its share of a TAB distribution scheme.

However, the combination of a fall in overall wagering and the loss of market share Tabcorp has seen this fall to $72.4 million in 2023/24 with Racing NSW providing $9.2 million to boost the ATC’s revenue from wagering to $82.8 million.

McGauran has foreshadowed a potentially bigger economic blackhole for the ATC – and the NSW racing industry in a broader sense – if gambling revenue doesn’t increase.

“The ongoing downturn in wagering is a growing issue for the ATC,” McGauran wrote in the ATC’s annual report.

“We are fortunate that Racing NSW has provided the club with additional funding … (but) continued wagering declines may affect Racing NSW’s ability to provide top-ups in the future.”

Tabcorp’s deal with the NSW racing industry is currently under government review, something which could have a profound influence on the ATC’s bottom line.

The ATC’s overall revenue in 2023/24 increased 6 per cent year-on-year to $372 million and its operating EBITDA figured in an 88 per cent increase to $15 million.

It recorded a $9.9 million operating loss in 2022/23, but marked it down as a year of small profit, $247,000, overall.

McGauran said higher inflation and cost-of-living pressures meant revenue from sponsorships, admission fees and hospitality was also affected by economic headwinds.

The ATC’s ongoing financial malaise and the funding model it operates under have been two of the most important issues linked to a controversial proposal to sell Rosehill racecourse.

“Continued wagering declines may affect Racing NSW’s ability to provide top-ups in the future.” -Peter McGauran

McGauran and the ATC executive have been in the crosshairs of members since the potential sale was announced almost 12 months ago and at least three candidates trying to win a seat on the board are campaigning on an anti-Rosehill sale agenda.

In September an influential group of ATC tried to organise a petition to remove McGauran over his handling of the Rosehill issue.

A parliamentary inquiry into the ATC’s dealings with the NSW government and the involvement of Racing NSW in an unsolicited proposal process was opened in July.

The Select Committee report is due to be handed down in December as McGauran says a due diligence phase continues before a possible membership vote to sell the racecourse is taken on April 3.

“I acknowledge there have been strong views expressed against the redevelopment of Rosehill racecourse,” he said.

“(But) the potential for the proposal to secure the club’s financial future is too significant not to be fully and rigorously investigated.

“The proposal is a once-in-a-generation opportunity to provide the ATC with a future income stream which is not dependent on wagering.

“This would secure the ATC’s financial independence and long-term future.”

The ATC annual general meeting will be held at Rosehill on November 28 with 10 candidates running for the two board positions, including vice-chair Tim Hale.

Hale, a high-profile property lawyer, gave evidence at the parliamentary inquiry into Rosehill’s future.

During the hearing, he cast doubt on a $5 billion valuation of a rezoned Rosehill for a housing redevelopment in an opinion that put him at odds with McGauran’s evidence.

Nevertheless, in a letter to the membership, McGauran and current board members have publicly endorsed Hale for re-election. Hale was appointed in 2021 and elevated to vice-chair in 2022.

“His knowledge of the club and his experience as a director remain assets to the ATC,” McGauran wrote.

Also backed by Inglis chair John Coates and prominent Sydney racehorse trainers Gai Waterhouse, Chris Waller and Bjorn Baker, Hale has laid bare the ATC’s economic woes with his re-election bid.

He is pushing for a new funding model to “enable the ATC to receive a share from wagering revenue which fairly reflects the contribution made by our four racecourses”.

“Broken escalators should not go unrepaired due to lack of funding,” he wrote.

Two candidates, David Walter and Annette English, have the support of the Save Rosehill Group which involves lobbyists who have prominent roles in the racing industry.

“In the upcoming election, we believe that candidates’ positions on the threat to sell Rosehill should be a threshold issue when members consider their vote,” Save Rosehill Group campaigner Julia Ritchie, a former ATC director, said.

“Save Rosehill is confident that ATC board candidates Annette English and David Walter understand the vital importance of preserving two Group 1 racetracks in metropolitan Sydney and are opposed to the sale of Rosehill Gardens if there is a possibility this principle may be compromised.

“We believe these two candidates possess the necessary governance skills and commercial acumen to contribute to the future of our club.”

READ: The full ATC annual report

Development consultant Brad Harris and accountant Heath Stewart are also board candidates opposed to the sale of Rosehill.

The ATC’s former general manager of racecourses Lindsay Murphy has also joined the election race, along with Brigid Kennedy, Symon Brewis-Weston, Lynette Bruce and Brian Cunningham.