Hoad’s road to integration – Racing Victoria’s media pivot

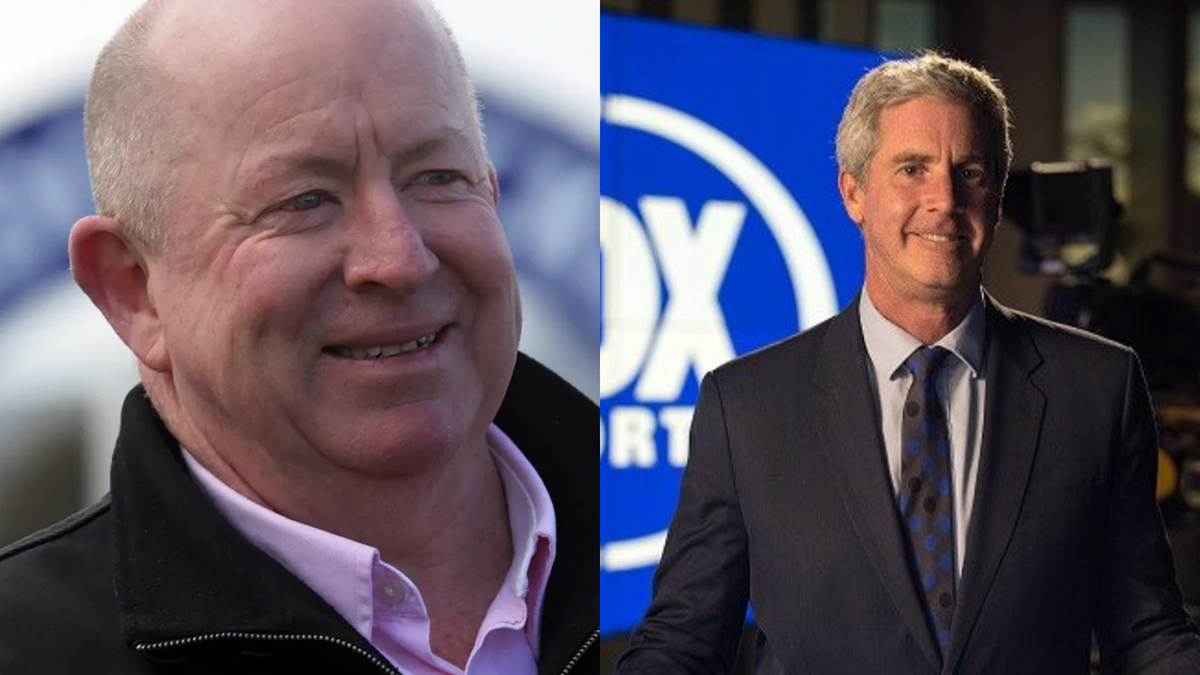

Andy Hoad, Racing Victoria’s latest recruit, helped Entain build an integrated media business from the ground up. But bringing Victoria’s racing media assets together into one functional business is a hill on which plenty of previous executives have faltered.

RV CEO Aaron Morrison tells The Straight why it is different this time around.

From the moment Racing.com was brought into existence in 2014, there have been promises it would be a fully integrated media business, uniting all of the Victorian racing industry’s media assets under one banner.

A succession of executives has come and gone, but even putting the word ‘integrated’ in the heart of the name of the business from 2021 until 2023 (VTRIMB), did not achieve the desired outcome. The various operational aspects, broadcast, digital, radio and print, remain siloed.

Racing Victoria believes it has taken the biggest step in achieving that vision for real integration, with the appointment of Entain executive Andy Hoad as Executive General Manager (EGM) – Media, Content and Marketing.

It will be Hoad’s role, with the oversight of Racing Victoria CEO Aaron Morrison, to bring those media assets together. He will be empowered by the fact that, for the first time, the Racing.com media business will be directly answerable to the RV executive.

“The big point of difference is they’re not separate businesses from a governance perspective anymore,” Morrison told The Straight.

“We’ve removed those layers of governance and decision-making and everyone’s going to be aligned around one strategy, part of one business.”

That strategy? Putting racing in the spotlight, not just focusing on media revenue.

Morrison has already dissolved the separate board and eliminated the role of Racing.com CEO, previously held by Peter Campbell, who has remained with RV while the transition takes place.

In Hoad, RV gets a content-first executive with an extensive broadcast production background who has driven off and on-brand strategies.

His track record at Entain – where he successfully integrated Ladbrokes, Neds, and New Zealand racing media assets – made him a natural fit for Morrison’s vision.

“This is where Andy’s experience with Entain is really relevant,” Morrison said. “They didn’t have the broadcast business in Australia, but they had great ideas to appeal to racing fans to drive their brand.

“They’ve done documentaries, they’ve got the stars and the talent, they’ve got Bossy (Glen Boss) and Ollie (Damien Oliver) and all those guys, and they do that original content piece really well.

“Then they then took over the operations in New Zealand and picked up the equivalent of Sky Channel, Trackside TV, the equivalent of RSN, SENZ.

“They’ve integrated them into one singular business, and they’ve started leveraging and organising their talent and contributors more effectively across those assets. And they’ve actually done a pretty good job of creating a truly integrated racing media business.”

Bringing everything under one roof also creates commercial efficiencies.

“The big point of difference is they’re not separate businesses from a governance perspective anymore.” – Aaron Morrison

A state-based Principal Racing Authority (PRA) only has so many resources at its disposal and the cost of the media business – around $62.7 million last financial year, according to the RV annual report – has long been a point of agitation among Victorian industry stakeholders.

The RV CEO admits the failure to bring together Best Bets, Winning Post, Racing Photos and Racing.com, along with RSN, which is majority-owned by RV, has come at a cost.

But far greater, according to Morrison, has been the opportunity lost.

Racing.com had been focused on a “brand-first” strategy, drawing audiences to its own platforms. But with media consumption changing, Morrison says they needed to rethink that approach.

“We’ve always positioned ourselves as the one-stop shop for Victorian and South Australian racing, but audiences are shifting. We need to be where they are,” he said.

Racing Victoria has already begun a round of discussions with major media partners, working with the likes of NewsCorp and the Seven Network, to open up what Morrison admits had been a ‘closed shop’ around Racing.com.

The other challenge is revenue.

Wagering partnerships have been a big income driver, but with new deals being negotiated, Morrison acknowledges that some major sponsors may scale back their investment.

Government uncertainty around wagering advertising isn’t helping either. However, Morrison is hopeful that racing media might get a carve-out, which could work in RV’s favour long-term.

That does give Morrison some optimism as does the aspirations of the medium-size operators who are keen to grab a larger slice of the market.

Betr has grown significantly in profile since its merger with BlueBet and recently acquired racing-led bookie TopSport as it targets at least 10 per cent of the market.

PointsBet is another operator looking to grow its market share, albeit it has put a significant focus on sports betting.

“Some bookmakers may pull back, but plenty of others are keen to access our audience and content,” Morrison said.

Still, RV wants to diversify beyond wagering revenue. Morrison sees media engagement as a way to drive overall interest in racing, which ultimately boosts wagering turnover.

“The thing that’s sort of different with us is it doesn’t just stop at the direct return from the media business and the content that’s being created,” Morrison said.

“That drives engagement, which leads to wagering turnover growth. So we get paid further down the chain through the wagering turnover, ultimately as a consequence of increased engagement, increased awareness, increased availability of our content.”

The question is how does RV intend to measure that impact, given it is not directly quantifiable?

“It’s very hard to measure that direct correlation, but I think you have strong indicators that those sorts of dynamics are happening,” Morrison said.

“We can at least do a better job of measuring the direct engagement and the direct audience better than we have been. That’s certainly an area for immediate improvement.”

The challenge is now over to Hoad, who begins his role mid-March, to deliver on that strategy.