Huge spring carnival delivers betr into profitability ahead of schedule

A boom set of spring carnival results has helped the newly merged BlueBet/betr outfit to half-year profit as it built its active client base under the refreshed betr brand to 145,000.

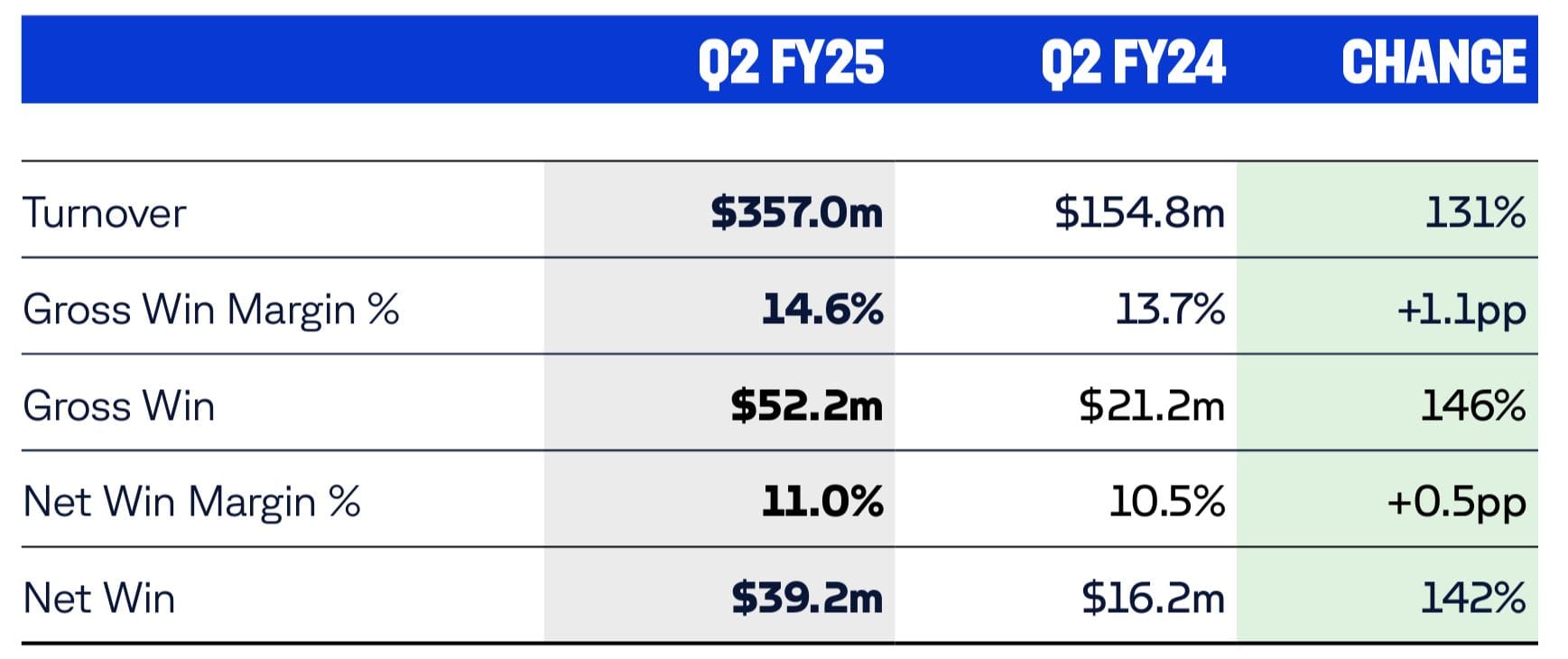

The topline numbers for the first half of the 2025 financial year were very strong for BlueBet Holdings, now betr’s parent company, with an EBITDA positive half delivered ahead of schedule driven by gross win of $52.2 million and net win of $39.2 million.

Speaking on the parent company’s quarterly earning call, CEO Andrew Menz said the key focus of growth had been targeting the existing betr client base and re-activating them on the platform which underpinned the BlueBet brand before they merged in July last year.

“Having set ourselves the target of reaching monthly EBITDA profitability by the end of the first half, we achieved that goal ahead of schedule and we have been profitable on a normalised basis each month since November,” Menz said.

“Today we announced that our demonstrably strong Q2 performance allowed us to deliver a normalised EBITDA positive first half in FY25.”

It reported that its active client base was 144,697, a 20 per cent jump from the first quarter of the year as it officially brought together the two brands under the one betr umbrella.

An extremely successful Melbourne Cup carnival saw betr record a gross win margin of 16.8 per cent, 4.6 points above the industry average, while its overall net win on racing grew 18.7 per cent across the half.

Those profitable returns on racing will be seen as positive by racing administrators, who have been concerned by the migration of turnover and market share towards sports betting in recent years,

“Migrated betr customers are delivering higher levels of racing net win year-on-year through a combination of improved product mix and materially lower cost of service through more efficient and targeted promotions,” COO Bill Richmond said.

“This highlights the strength of our offering and the ongoing opportunity in front of us as we continue to expand our customer base organically and through the strategic reactivation of betr customers, including into Q3 with the autumn racing carnival and football seasons.”

At a time where the major wagering service providers (WSPs) are reporting that active clients are spending less on average, the turnover per active metric for betr has grown, especially in sports multis where it has increased by 38 per cent.

Indeed the future looks even more positive for the publicly listed company after its exit from the US market last year, according to Menz.

“I think there was accelerating momentum in the back half of January that we saw, particularly around the Australian Open and some other events that we were pushing quite heavily through Magic Millions being delayed by a week,” Menz said.

“We take great momentum out of that January month, both from an activity perspective, as I say, in terms of the active client, but also maintaining those net win margins.”

More broadly, Menz said the new company, which as of January 1 has been chaired by Australian corporate bookmaking pioneer Matthew Tripp, was in a strong position for long-term growth.

“We know what works, and we understand the importance of the strategic reactivation of our customer base to ensure we’re scaling for profitable growth and efficient unit economics,” he said.

“And the successful execution of combining these two businesses demonstrates our strong capability to continue to deliver value as we grow.”

While the company forecasted a stronger marketing spend 2025, especially in the lead-up to domestic football seasons and the autumn racing carnival, Menz said a key opportunity for growth lies in acquisition.

Given the success of the BlueBet/betr merger, he predicted further acquisition plays in the near future.

“The inorganic opportunity, due to a pretty fragmented Australian wagering market and some challenges being faced by a number of operators, both at the top and the lower end of the market, give us confidence that M&A is afoot,” he said.

“We really do see that as a key strategic path for us to get to that 10 per cent market share.”

Menz said that as things stand, betr holds between four and five per cent of the Australian online betting market.