Rosehill inquiry urged to examine Racing NSW’s financial reporting

A former NSW auditor-general wants Racing NSW to be held to the same level of accountability that applies to other government statutory bodies, urging a parliamentary inquiry to investigate the thoroughbred regulator’s finances.

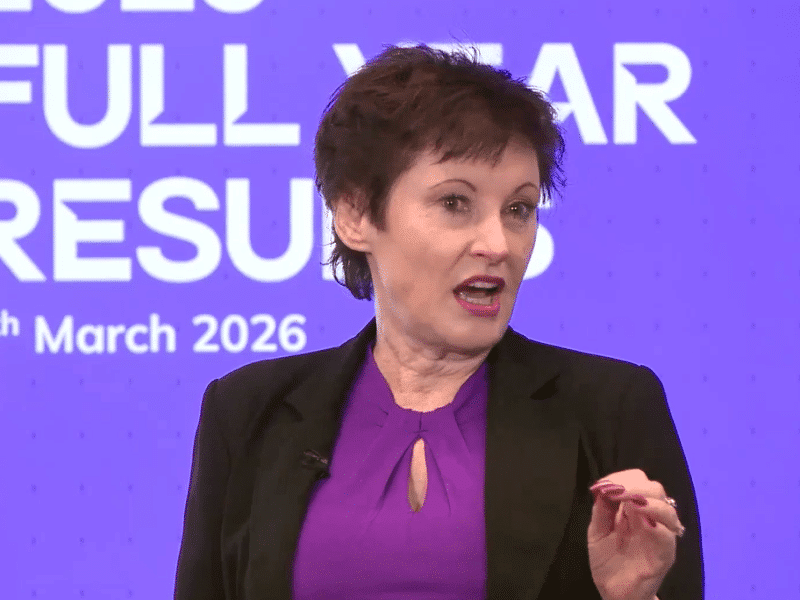

In a written submission to the Select Committee established to inquire into the proposal to develop Rosehill for housing, Tony Harris, who was auditor general from 1992 until 1999, says Racing NSW’s financial statements need closer scrutiny.

Under the NSW Thoroughbred Racing Act 1996, Racing NSW must provide an annual report to the NSW Racing Minister.

However, unlike other state statutory bodies, Racing NSW’s financial records are not examined by the Audit Office of NSW.

“ … atypically, and perhaps uniquely for a state-owned corporation, these financial statements are not audited by the NSW auditor-general,” Harris, who served as NSW auditor-general from 1992 until 1999, wrote.

Harris also urged the inquiry to investigate the potential windfall for Racing NSW should it benefit from proceeds of a Rosehill sale.

“It is inconceivable that Racing NSW would receive these monies and still not be subject to audit and oversight by the NSW auditor-general,” he said.

“The substantial increase in the financial capacity of Racing NSW that would result from this transfer suggests that the committee should examine the over-sighting provisions that apply to Racing NSW.

“Indeed, there are persuasive existing grounds to recommend that these over-sighting provisions be brought into line with those applying to state statutory bodies.”

“It is inconceivable that Racing NSW would receive these monies and still not be subject to audit and oversight by the NSW auditor-general.” – Tony Harris

For accounting purposes, provisions are expenses that can be used to cover expected future losses. They are listed on a balance sheet under liabilities.

But Harris’ submission raises concerns about the nature of these expenses on Racing NSW’s books.

“While provisions such as these are common in entities’ financial statements, Racing NSW financial statements have provisions that appear not to represent ‘a present legal or constructive obligation as a result of a past event’,” Harris claimed.

As an example of Racing NSW provisions, Harris cited the $116 million put away for capital projects, $36 million to support race clubs encountering financial hardship and a further $106 million to sustain increases in prize money.

“Although these are audited figures, there is sufficient information to suggest that some of these provisions do not meet the definition of provisions set down in accounting standards,” he said.

Harris’ submission came as the committee heard a damning appraisal of Racing NSW’s financial reporting.

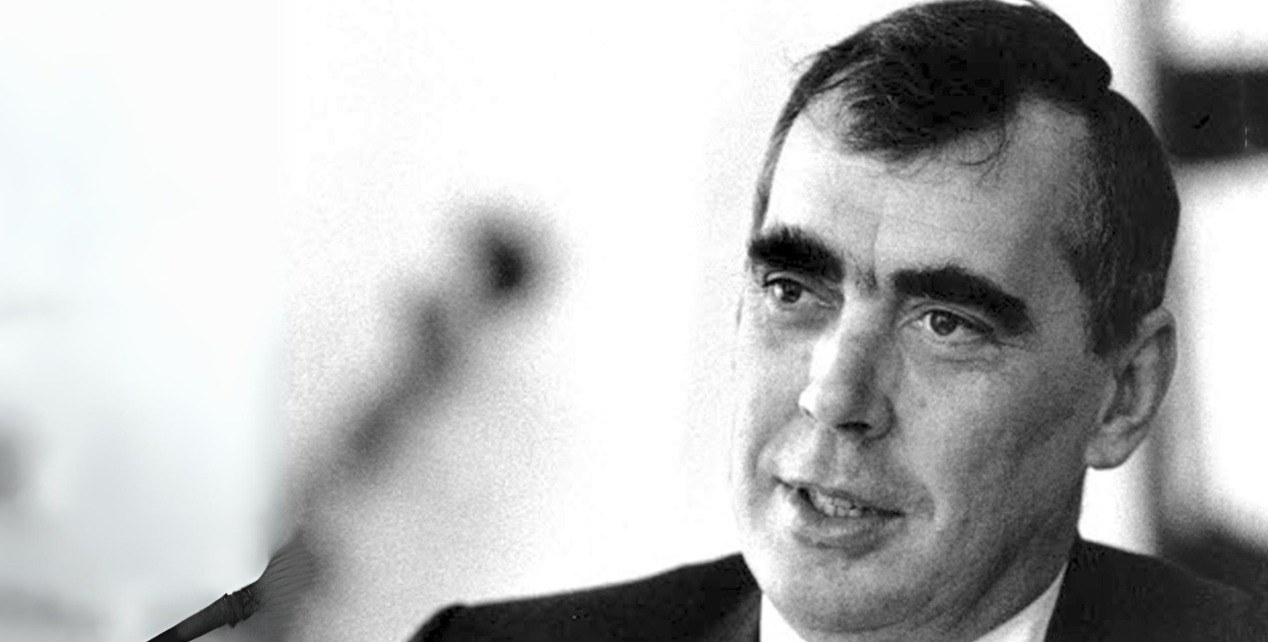

Former Australian Jockey Club chairman David Hall described the Racing NSW annual report is “appalling” at his appearance at the inquiry on Monday.

“It certainly doesn’t comply with ASX standards of presentation and detail, nor general accounting standards and annual report and governance,” Hall, who holds a fellowship with the Institute of Chartered Accountants, said.

“It is really a closed, hidden shop … they just make a general reference, no detail.”

The Minns government abandoned legislation last year to extend the term of then-Racing NSW chairman Russell Balding rather than support amendments that would have subjected the organisation to greater oversight.

A condition of the Coalition supporting the extension of Balding’s term was that Racing NSW be subjected to deeper scrutiny.

This would have included Racing NSW leaders being called before budget estimates hearings and audits by the auditor-general.

“That would have been a step in at least getting some accountability … it was good decision-making had it been allowed to occur,” Hall said.

“But the changes need to be far more assertive than that. There’s a long history of why monopolies, and particularly dictatorial monopolies, don’t succeed in the long run.

“And unfortunately that is what we have.”

Asked if Racing NSW was acting outside of its statutory remit by accumulating an extensive real estate portfolio, Hall replied: “Absolutely.”