With the 2024 Australian yearling season now complete, the final stats are in and while averages and aggregates remain historically high, so too does the number of horses sent back to their vendors.

In a discerning yearling market like we have in Australia at the moment, horses which don’t make the grade don’t get sold.

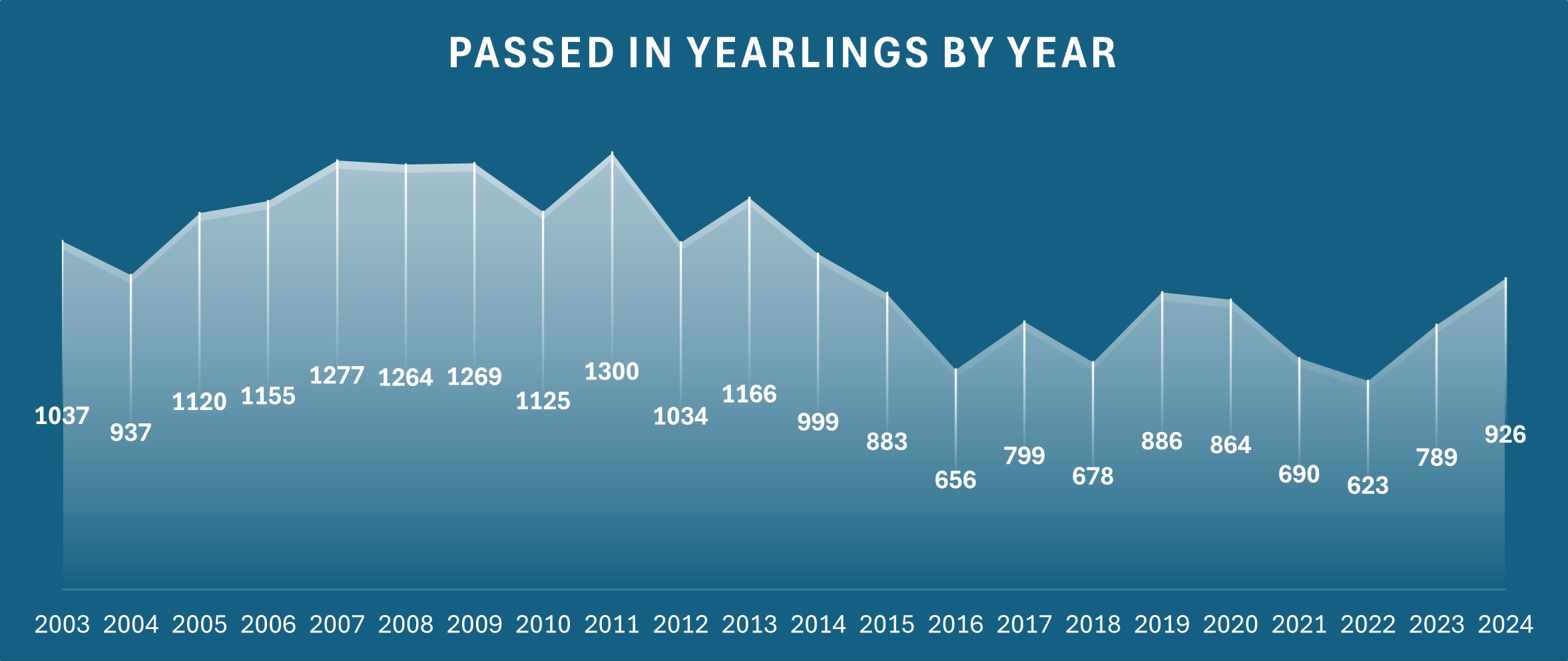

Across the 11 major Australian yearling sales in 2024, it is notable that 926 lots were passed in. That number is the highest of any Australian sales season since 2014, and a 48.6 per cent jump in the space of just two years. A historically low number of 623 yearlings were passed in during a record-breaking 2022 season.

The total number of horses offered has remained remarkably consistent across the past 12 years. With the exception of the pandemic-impacted 2020 season, numbers of yearlings presented at major Australian auctions have remained within an 8 per cent band between 4869 and 5265 since 2012.

It follows then, combining the two sets of data above, that the 2024 clearance rate is also at a low ebb when compared to the past decade. This year the clearance rate finished at 81.6 per cent. The last time it was lower than that was back in 2014 when it was 79.9 per cent.

Interestingly, annual clearance rates in the past 10 years have been much higher than they were in the decade prior. That stat didn’t break through 80 per cent in Australia in any year between 2004 and 2014 and this year’s figure of 81.6 per cent is marginally above the 20-year average of 81.1 per cent.

The simple expression of the above is that the market purchased fewer yearlings this year, 4100, than it has in any season since that 2014 season. The number of yearlings purchased was 152 down on 2023 and 475 fewer, or 10.4 per cent, than when it peaked in 2021 at 4575.

The only year in history which saw more yearlings purchased through public auction in Australia than 2021 was 2007, which was just before the GFC-triggered bloodstock bust.

It would be easy to characterise the sharp rise in pass ins, and corresponding drop in yearlings purchased as following a similar manner to that bust, but that would ignore a couple of very important metrics.

The average price of an Australian yearling purchased at auction in 2024 was $138,606. This is the second highest on record (in 2022 it was $140,963) and over twice as much as it was in that 2014 season we keep coming back to.

Similarly, the total investment in yearlings in Australia in 2024 was $568 million, the third most of any year on record. The market may be 10.6 per cent off its 2022 high, but it is still worth 108 per cent more than it was a decade ago.

There is one key assumption we can make from this data. While the selection of horses is more stringent, those who do make the grade are being valued at record levels.

The year-on-year stats comparison between 2024 and 2023 backs this up.

First of all, the median from 2023 to 2024 remained exactly the same at $70,000, while the average rose 2 per cent.

The number of million-dollar lots did fall from 47 to 41, but the number of horses sold for $250,000 or more rose slightly from 663 to 664.

Also pointing to a more divided market was the fact that the average price of a horse which cost $100,000 or more was higher this year at $287,147, compared to last year when it was $280,635.

Horses which cost less than $100,000, meanwhile, averaged less this year than last ($38,593 to $39,444).

When we break down the individual results by sale we see those sales at the lower end suffered disproportionately when it came to market downturn. Inglis Melbourne Gold Sale was down 35.7 per cent on aggregate, Inglis May was down 33.2 per cent and Magic Millions Tasmania was down 29.1 per cent.

The sale which had the biggest upturn in terms of aggregate by percentage was the most ‘select’ of the season, Inglis’ Easter Sale. which went up 9 per cent.

Only one sale of the 11 staged saw a jump in the number of horses sold, which was Perth, while seven of the 11 featured a drop in average.

If there is some insight to be had into what the 2025 Australian yearling market may look like, there was an inkling in the final three yearling sales of the season.

What we saw at the Melbourne Gold, Inglis May and Magic Millions National Sale was that vendors were much more willing to meet the market.

These three sales were the only ones on the calendar to pass in fewer horses than they did in 2023.

Comparison of key metrics for Australian yearling sales 2023 to 2024

*Source: arion.co.nz