Seven days in … wagering – The house that Gill rebuilt

In this edition:

- ‘We’ve come a long way’ – Tabcorp’s fortunes turn around on Victorian deal and leaner model

- ‘A unique part of the on-track experience’ – Deal done to partially restore on-course tote service in Victoria

- Entain appoints Andrew Vouris as permanent CEO

- Betr linked with Entain discussions

- Flutter exits India after bill kills legalised online gambling

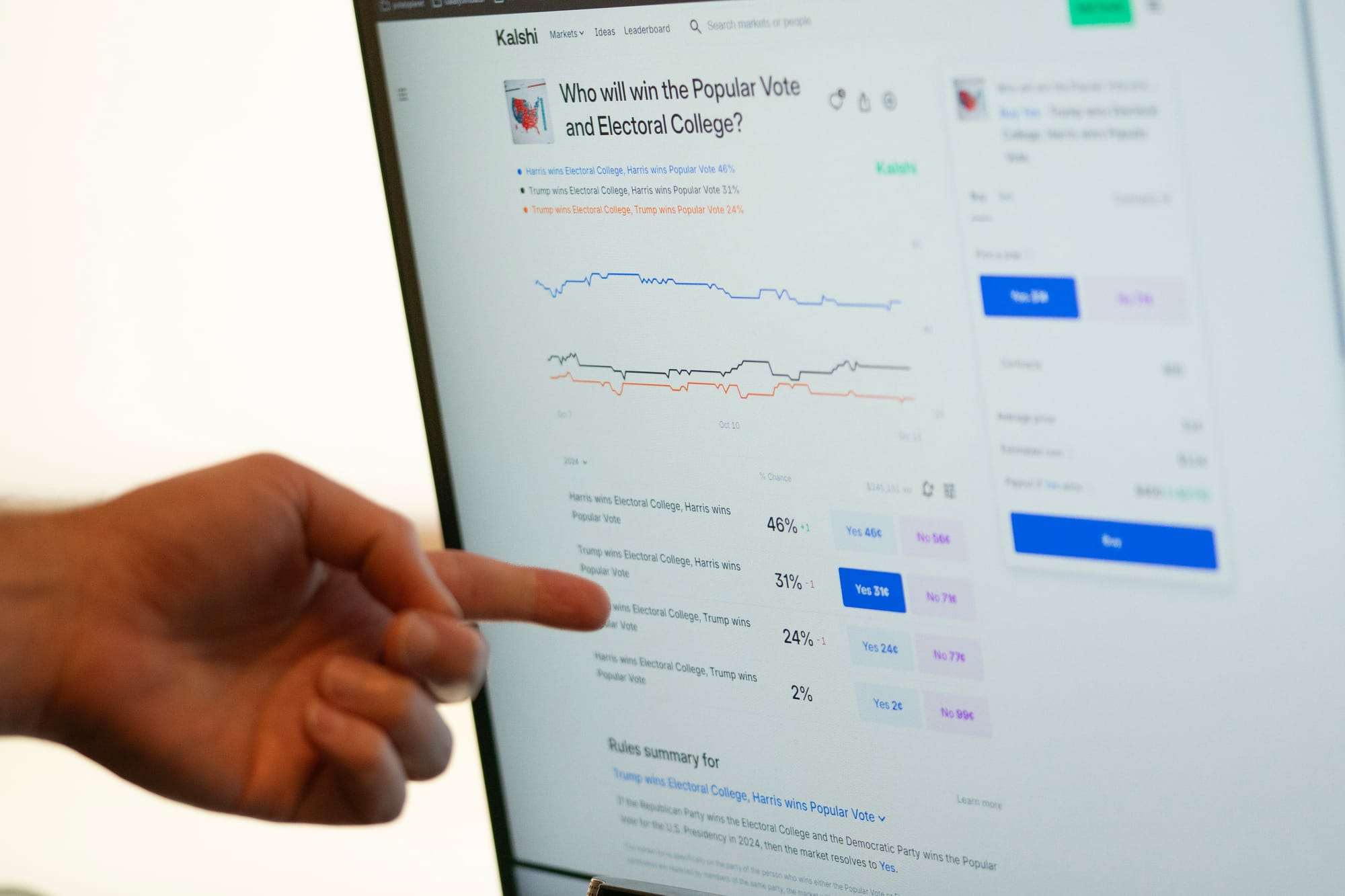

- The Next Era of Prediction Markets

Gill McLachlan’s plans to get Tabcorp to capitalise on its key market advantages, retail and tote, are taking shape. Twelve months on from his arrival in the midst of a storm, the wagering giant with a significant history but an uncertain future, seems to be sailing into calmer waters.

That is the opinion of investors, with Tabcorp’s shares soaring 30 per cent since McLachlan announced a modest profit of $36.6 million and jumps in revenue and EBITDA in Tabcorp’s annual results, released on Wednesday. Shares haven’t been this high in nearly two years.

It was a world apart from last year’s $1.4 billion loss, albeit there was a sense of Tabcorp “taking out the trash” on that occasion to give McLachlan every chance to pilot in an upward direction.

The former AFL CEO promised a fitter Tabcorp, and with nearly $40 million in op-ex savings, the flab is disappearing. Tab Time is up and running as is a significant trial of in-venue in-play betting in New South Wales.

Retail has been prioritised and invested in, and the past year saw a 17.5 per cent jump in cash betting, something which defies broader societal trends and raised the eyebrows of a couple of TAB’s rivals in an era which demands greater transaction transparency.

McLachlan is hellbent on achieving the national tote and believes he can do it in the next 12 months.

“The national tote piece, I think I’ve been quite assertive in my language on that to date, and I’m aware of the accountability of delivering that, but we are well advanced in a tech sense,” he said.

“The commercial model is a big challenge, but we’ve got a good relationship with the PRAs. I am optimistic the national tote, we can see it landing in this financial year.”

That will be music to the ears of parimutuel punters, who have long craved larger liquidity.

McLachlan was less bullish on the progress of a new deal in New South Wales. Given the new Victoria deal pushed Tabcorp’s EBITDA into positive territory, it is little wonder Tabcorp is keen to change things up north of the Murray.

But while McLachlan and Racing NSW CEO Peter V’landys are working towards a solution, the Tabcorp CEO poured cold water on hopes of a quick result.

“We’ve got a good relationship with the industry in New South Wales, and we’ve got a broad plan that requires the best of the industry. We’re determined to get there, and that may take some time,” he said.

The other lesson for the racing industry is that while Tabcorp appears to have turned a corner, racing turnover is still in decline, down four per cent over the past 12 months, while sports turnover has grown by 5.3 per cent.

It was also interesting to see Tabcorp reach an agreement with Racing Victoria and Country Racing Victoria to ensure that more meetings had TAB operators on site.

‘A unique part of the on-track experience’ –

Deal done to partially restore on-course tote service in Victoria

Entain confirmed this week that Andrew Vouris would fill the role of permanent CEO of its Australian and New Zealand arm, having sat in the role on an interim basis since Dean Shannon’s departure in June.

It’s a significant moment for the owners of Ladbrokes and Neds, as well as the partner of TAB NZ, as uncertainty persists over the pending fine from AUSTRAC.

The Straight has a one-on-one interview with Vouris in the coming days. Keep an eye out for it.

Betr has confirmed it recorded an EBITDA positive of $7.2 million in the 2024/25 financial year. In its first full year post the BlueBet merger, it grew turnover to $1.4 billion, with gross win of $196 million. It also revealed that 80 per cent of its turnover was generated from racing.

Earlier this week, betr was linked with a bid for Entain’s Australian operations, as the corporate rumour mill heats up again ahead of spring.

MIXI and betr have continued their bidding dual for PointsBet, each upping their offer, while rejecting any idea that one of them might accept the other’s cash and drop out. PointsBet’s full-year results will be interesting reading when they come out on Friday.

And in the latest Waterhouse VC column, the role of prediction markets in America is discussed as Flutter looks to enter the market after a recent deal with CME Group.

Enjoy your wagering week,

Regards

Bren O’Brien

Managing Editor and Founder

The Straight