The Point of Consumption tipping point – Does Queensland move first?

With the outcomes of the Queensland racing review imminent, there is growing confidence that a reduction of the state’s Point Of Consumption Tax rate may be on the cards. Bren O’Brien investigates what it could mean for the funding of racing in the state.

Analysis: Matthew McGrath’s long-awaited review into racing in Queensland is expected to be made public within weeks. Compiled on the behest of Racing Minister Tim Mander, it is set to provide a major shake-up into the way racing is run and funded in the Sunshine State.

In terms of racing reviews, it has progressed with relative speed compared to those conducted interstate. It is less than a year since Premier David Crisafulli came to power and just over six months since former Australian Turf Club chair McGrath was appointed to lead the review by Mander.

It is true, though, that racing in the state has been a holding pattern since the review was announced – Racing Queensland effectively has both an interim chair, Steve Wilson, and an interim chief executive, Lachlan Murray.

The release of the report in the coming weeks may prompt a sudden wave of change with Wilson expected to depart, while the appointment of a permanent CEO will be considered a priority for any new look board, with Murray seemingly holding the front running.

But the number one question coming out of the review will be whether McGrath recommends a change to the Point Of Consumption tax regime.

Ever since Queensland went to a 20 per cent in December 2022, the major corporate bookmakers, with the exception of Tabcorp, have been rallying for a revision back to 15 per cent.

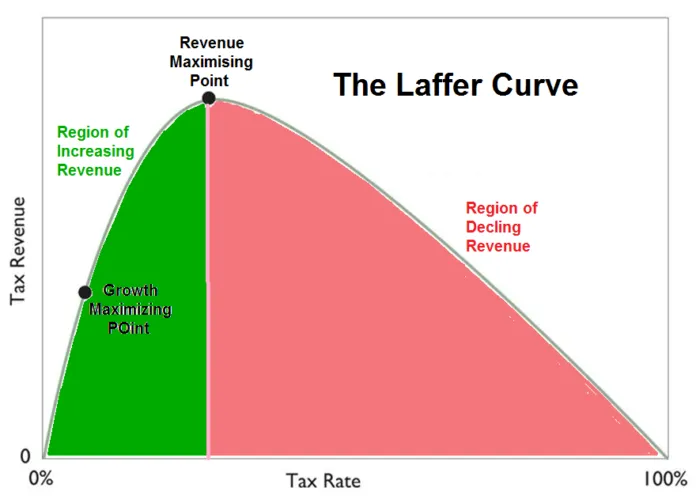

The consensus was that the push to 20 per cent, which had been accompanied by a change in the Racing Queensland funding model, had gone too far. As per the popular concept of the Laffer Curve, taxation had begun to disincentivise consumption, and the net result was a negative.

The Queensland treasury has maintained bullish projections as to the ongoing growth of wagering and betting taxes, but the feedback from bookmakers and the racing industry is that this is not realistic.

They have pointed to the ACT, where POCT sits at a national high of 25 per cent. As turnover has plummeted, the government there now collects less tax now than when the tax rate was at 20 per cent. That suits those who might want to tax gambling out of existence, but is not good for government coffers.

But in a complex eco-system like wagering, the Laffer Curve is arguably too simplistic. It assumes the sole disincentive to consumption is the cost of taxation, and does not account for other external factors, like the broader cost of living crisis.

Laffer also points to the fact that a lowering of the POC tax rate would mean an automatic rise in turnover.

But in documents seen by The Straight, leading bookmakers are not predicting that a possible drop in Queensland’s POCT rate will necessarily see a revival in turnover. Even if it did, it is likely to be only in the realms of a five per cent jump, not enough to offset the circa $70 million less revenue at the lower tax rate.

So, what government would sign on to getting less tax revenue? Certainly not a Queensland government which faces a raft of budgetary challenges, including hosting an Olympics in seven years.

As it already passes on 80 per cent of POCT revenue to the racing industry, the Queensland government currently receives about $57 million in net tax receipts from this source. Should it want to retain that guarantee, then it may be that Racing Queensland needs to take a smaller slice of a smaller pie.

Again, RQ is hardly equipped to take a $70 million haircut off its existing operational costs, so it would need to look to secure funding from elsewhere.

The other lever it has at its disposal is race field fees – what it charges the bookmakers to bet on its product. The current net rate on that is 2.2 per cent for the major operators, which generated circa $132 million a year for RQ in its most recent annual report.

While increasing race field fees to cover off POCT shortfalls would appear to be the wagering equivalent of robbing Peter to pay Paul, it would achieve one significant thing.

It would allow the racing body to have greater control over the elasticity of pricing. It could opt to alter its pricing structure to incentivise turnover and promotion, without relying on the government risking a greater share of POCT receipts.

The lever would now be back on the hands of the regulator, which could then adjust pricing according to demand. It would also, according to projections, see race fields return as the primary source of industry funding again.

It’s an approach with some drawbacks, and could adversely impact smaller bookmakers, but it has some key supporters in the wagering and racing game.

It could also have the compounding impact of encouraging a couple of the major bookies, which have been disincentivised to promote Queensland racing, to open up the purse strings to punters.

When the POCT rate went up, it divided the wagering industry, who felt Tabcorp had got a sweetheart new deal. Sentiment is more collegiate around the approach this time around, and McGrath’s review has been told this.

The Queensland POCT situation has strong resonance for the rest of Australia, particularly New South Wales. The long-term Tabcorp-New South Wales agreement is up for discussion with Peter V’landys and Gillion McLachlan said to be leading the charge. A government POCT rise is said to be off the agenda in any reform.

Should a reduction of the tax rate deliver a bigger bump in turnover than expected in Queensland then several other states may start to look at their arrangements. Competition for the punting dollar could become much stronger if there are tax dollars to be won.

As mentioned, none of this happens in a vacuum. Tasmania is fronting up to a greyhound racing ban in 2029, which threatens 37.6 per cent of turnover, while there is major political scrutiny on that code in almost every other state.

That is before we get to the inevitable day that sports bodies start knocking on the door of the treasuries asking for their clip of the POCT which sports betting generates.

A POCT-led funding model was borne out of the turnover booms of the post pandemic era. There were significant assumptions made which have not materialised, such as continued growth.

The shortfall in expected revenue in almost every jurisdiction tells us that the current model of POCT is not working as intended. It is just a matter now of which jurisdiction moves first to adapt their strategy. Queensland has the first opportunity.

Got an opinion on whether Queensland should reduce its Point Of Consumption Tax? Email editor@thestraight.com.au with your thoughts.