Waterhouse VC – New Dawn for Brazil

January 1, 2025, marked a watershed moment for Brazil’s betting industry. After years of operating in a grey market dominated by offshore operators and loosely regulated local outfits, the country now has a clear regulatory framework which has a zero-tolerance approach to unlicensed betting. Far from a routine policy update, Brazil is poised to become one of the largest regulated betting economies, with revenues forecast to reach $6.3 billion by 2038.

For operators, this formalisation presents a colossal but highly competitive opportunity. For suppliers, it signals fertile ground for innovation and strategic partnerships as firms seek to differentiate as they try and gain market share. And for Brazil itself, it’s the long-awaited chance to reclaim billions in tax revenue. If Brazil gets it right, the upside is enormous.

This month, we delve into the historical forces that shaped Brazilian betting – and the regulatory, technological, and cultural conditions that will ultimately define its future success.

From Casinos to the Streets

For over eighty years, Brazil’s betting scene existed largely in the shadows. The turning point was in 1946, when then-President Eurico Gaspar Dutra reportedly under the influence of his religious wife, outlawed casinos. Glamorous spots such as the Cassino da Urca and Copacabana Palace were repurposed, closing the doors on what had previously been thriving entertainment hubs.

But history proves that prohibition never kills demand; it merely pushes it underground. Cruise ships with onboard casinos in international waters proved a popular workaround, and Jogo do Bicho (“Game of the Animal”), emerged as the country’s de facto national lottery. First introduced in 1892 to raise funds for the Rio de Janeiro Zoo, it was banned three years later, but continued to thrive for over a century, operating as a shadow economy with strong ties to football, gangs and carnival culture.

Card games have long been a staple of Latin America, with poker – classified as a game of skill – flourishing both online and offline. The COVID-19 pandemic accelerated this growth, fueling a surge in online poker participation. Notably, Flutter’s PokerStars brand has opted to focus exclusively on poker in Brazil, an interesting differentiation in an increasingly competitive market. Today, Brazil is a global powerhouse in the game, producing top-tier professionals who compete and win on the world stage.

Horse racing has endured despite becoming increasingly niche. With the potential for high-margin, round-the-clock betting, racing could see a renaissance under clearer regulations. Brazilian jockeys like recordbreaker Jorge Ricardo and João “Magic Man” Moreira are well-known on the international stage and increased local interest – bolstered by operator partnerships – might breathe fresh life into racing.

Jogo Bonito

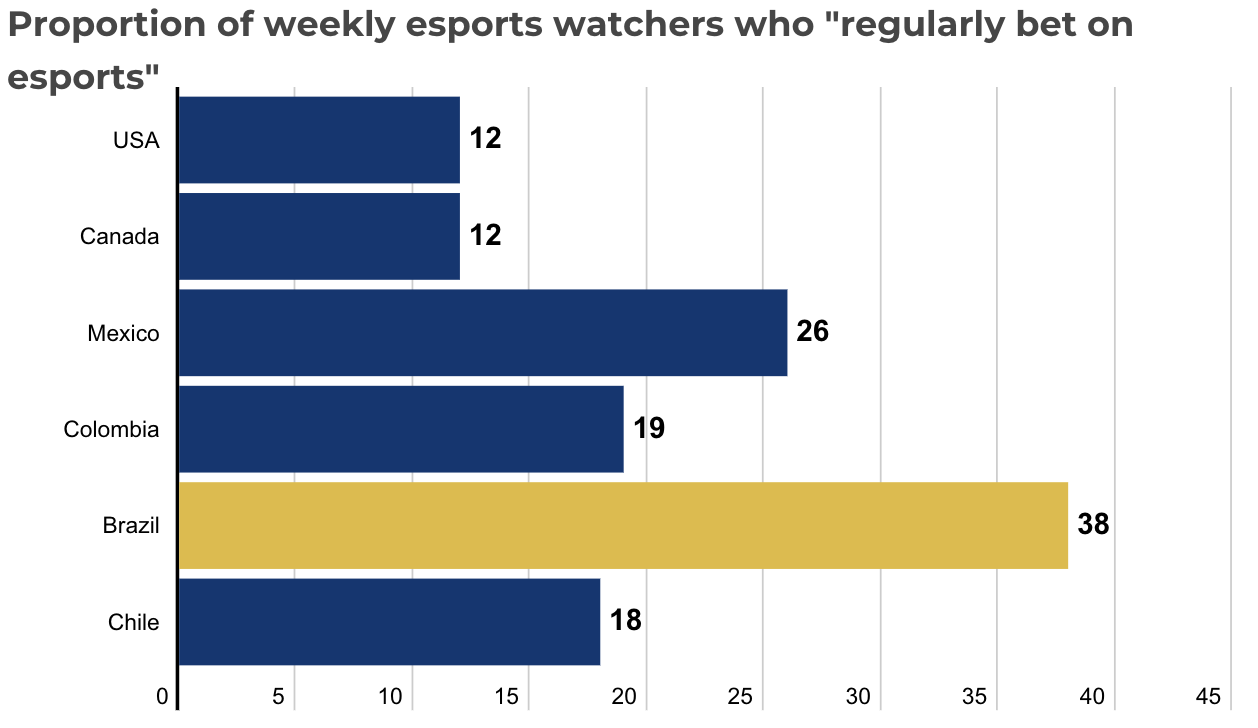

Few passions however burn brighter than football. It accounts for over 80% of all sports wagers, followed by basketball, esports, and MMA – all arenas in which Brazilians excel. Historically, most football bets were placed with street bookies, but the early 2000s internet revolution reshaped the landscape. A surge in mobile adoption and the growing ubiquity of digital payments, particularly Pix, (the central bank’s instant payments platform), made online betting easy and accessible. By 2018, billions of dollars were flowing untaxed to offshore sportsbooks, highlighting the regulatory vacuum and intensifying calls for reform.

Crypto Call

When Brazil first legalised sports betting in 2018 under then-President Michael Temer, the lack of a clear regulatory framework created a free-for-all. This coincided with the meteoric rise of cryptocurrencies and crypto-based casinos, making Brazil – with the highest digital penetration in the region – a prime target for offshore operators, many of which offered little to no player protections.

It wasn’t until December 2023 that the government took its first decisive steps toward regulation and by this point, wagering was deeply ingrained in Brazilian culture, with 39 of the 40 top-tier clubs sponsored by betting companies. By 2024, Brazil had become the world’s largest source of gambling website traffic, accounting for 15% of global visits. Surveys revealed that 68% of Brazilians engaged in some form of gambling, while 18% of the population – around 26 million people – held cryptocurrency. The online betting market was thriving, yet Brazil itself was missing out on billions in potential tax revenue.

Grey to Green

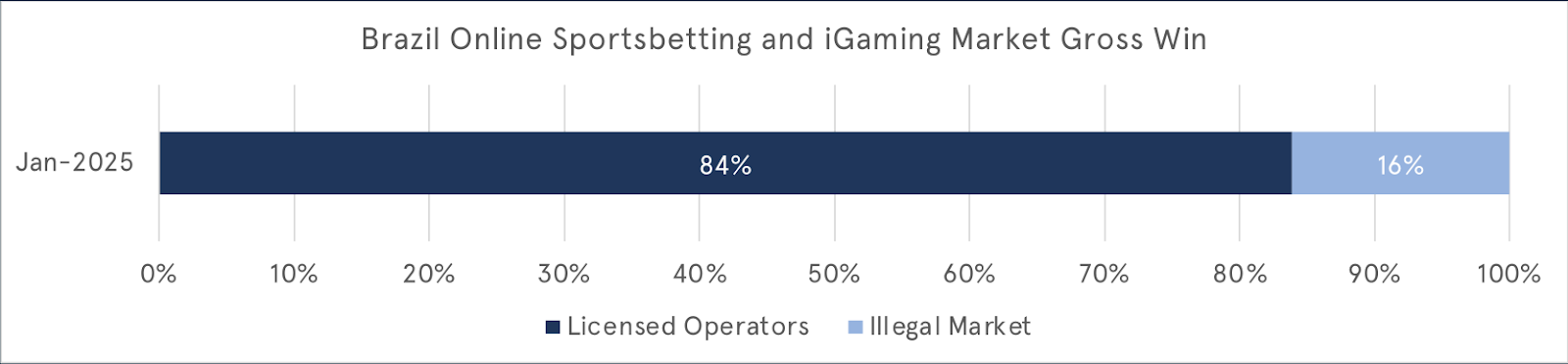

Brazil’s push to bring betting under formal oversight intensified throughout 2024, with bans on credit cards, cash payments, and crypto transactions. However, 2025 marked the true turning point – under President Lula, the country officially launched a fully regulated market for sports betting and iGaming, enforcing a zero-tolerance policy for unlicensed operators. Already, the regulatory agency has shut down or blocked over 8,000 illegal sites, though an estimated 16% of offshore activity still persists.

Shutting out offshore operators is challenging but Brazil has a key advantage in Pix. Owned and controlled by the Central Bank, Pix now handles 96% of transactions, offering instant payments – a great advantage in wagering. Unlike other jurisdictions with fragmented oversight, Brazil’s centralised system gives the Central Bank direct regulatory control, making it hard for illegal operators.

Cost To Compete

The barriers to entry are high, and the competition even steeper. A five-year operating license costs US$6 million, restricting the market to well-funded firms. New regulations mandate that companies must be established in Brazil and have at least one Brazilian holding a minimum of 20% of the company’s capital. Facial recognition technology for identity verification, and substantial financial reserves are also required. Additionally, platforms must exclusively support Pix payments, favouring domestic operators already integrated with the system.

The 12% GGR tax is attractive but it also intensifies competition. Only licensed operators using a ‘bet.br’ domain can sponsor teams or sporting events, making official market entry crucial for brand visibility. Top clubs, including Flamengo, Corinthians, and Palmeiras, have secured sponsorship deals exceeding R$100 million per year from operators such as Pixbet, Esportes da Sorte, and Sportingbet. These partnerships are critical, especially since the new regulations prohibit sign-up bonuses. There are even reports of football teams dropping advertising deals for higher-offers, such is the premium for brand exposure in such a competitive market.

In addition to the 12% GGR tax, there is a 15% withholding tax on player net winnings above US$547. Brazil’s betting revenues are set to fuel education, tourism, and sports through a lottery-style reinvestment mechanism.

Who Wins

The full version of this article is available on Waterhouse VC at the link below

Subscribe to Waterhouse VC here to receive regular updates

DISCLAIMER AND IMPORTANT NOTES

Please note the above information in relation to Cassino da Urca, Copacabana Palace, The Guardian, Flutter Entertainment, PokerStars, Yuri Dzivielevski, Cardplayer, Jorge Ricardo, João Moreira, IGB, MMA, Flamengo, Corinthians, Palmeiras, President Lula, President Michael Temer, Pix, Pixbet, Esportes da Sorte, NSX, Betnacional, Big Brother Brazil, and Sportingbet is based on publicly available information and should not be considered nor construed as financial product advice. The Fund currently has a position in Flutter Entertainment. The information provided in this document is general information only and does not constitute investment or other advice. Readers should consult and rely on professional investment advice specific to their individual circumstances.

Not for Release or Distribution in the United States of America

This material may not be released or distributed in the United States. This material does not constitute an offer to sell, or a solicitation of an offer to buy, any securities in the United States or any other jurisdiction in which such an offer would be illegal. The units in the Fund have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (the U.S. Securities Act) or the securities laws of any state or other jurisdiction of the United States. Accordingly, the units in the Fund may not be offered or sold in the United States unless they are offered and sold, directly or indirectly, in transactions exempt from, or not subject to, the registration requirements of the U.S. Securities Act and any other applicable United States state securities laws.

General Information Only

This material is for general information only and is not an offer for the purchase or sale of any financial product or service. The material has been prepared for investors who qualify as wholesale clients under sections 761G of the Corporations Act or to any other person who is not required to be given a regulated disclosure document under the Corporations Act. The material is not intended to provide you with financial or tax advice and does not take into account your objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by Sandford Capital, Waterhouse VC or any other person. To the maximum extent possible, Sandford Capital, Waterhouse VC or any other person do not accept any liability for any statement in this material.

Financial Regulatory Oversight and Administration

Waterhouse VC is an Australian Unit Trust denominated in AUD and available to wholesale institutional investors worldwide with a minimum of AUD 500,000 or USD / EUR / GBP / JPY / CHF equivalent. This material has been prepared by Waterhouse VC Pty Ltd (ABN 48 635 494 861) (‘Waterhouse VC’, ‘Trustee’, ‘us’ or ‘we’) as the Trustee of the Waterhouse VC Fund (the ‘Fund’). The Trustee is a corporate authorised representative (CAR 1278656) of Sandford Capital Pty Limited (ABN 82 600 590 887) (AFSL 461981) (Sandford Capital) and appoints Sandford Capital as its AFS licensed intermediary under s911A(2)(b) of the Corporations Act 2001 (Cth) to arrange for the offer to issue, vary or dispose of units in the Fund.

Performance

Past performance of Waterhouse VC is not a reliable indicator of future performance. We make every endeavour to ensure results are accurate. Waterhouse VC Pty Ltd does not guarantee the performance of any strategy or the return of an investor’s capital or any specific rate of return. No allowance has been made for taxation, where applicable. We encourage you to think of investing as a long-term pursuit. Waterhouse VC’s results are indicative only and subject to subsequent year end external financial review.

Copyright

Copyright © Waterhouse VC Pty Ltd ACN 635 494 861. No part of this message, or its content, may be reproduced in any form without the prior consent of Waterhouse VC.

Governing Law

These Terms and Conditions of use are governed by and are to be construed in accordance with the laws of New South Wales. By accepting these Terms and Conditions of use, you agree to the non-exclusive jurisdiction of the courts of New South Wales, Australia in respect of any proceedings concerning these Terms and Conditions of use.