With a week left until Australian Turf Club members decide the future of Rosehill racecourse, we look at the possible outcomes and what they may mean.

During last Saturday’s night news, the Australian Turf Club’s broadcast partner, the Seven Network, reported that should the Yes vote win out on April 3, then Saturday’s Golden Slipper would be the last run at Rosehill.

First things first, that is incorrect, with the ATC having already said that racing at Rosehill would continue until at least 2031 should a Yes vote succeed. It explicitly states this in its notice of meeting ahead of the extraordinary general meeting.

Secondly, it is just the latest example that if there has been one casualty in the fierce debate over the future of Rosehill, it has been clarity.

While both proponents and opponents have pushed their cases, the members themselves have not had the benefit of a clear run at the truth, despite knowing that they are the ones to determine if the ATC proceeds in selling off the club’s most valuable asset.

When the ATC confirmed on March 12 the resolutions on which the members will vote, it was hoped it would clear the decks and provide a degree of certainty of what was at stake.

But in what is a legal process, with language unfamiliar to most of the 11,000-odd members eligible to vote, just what is in question is still up for debate.

Those opposing the sale have a vested interest in muddying the waters, banking on that uncertainty to be enough to convince a majority of members to vote No.

The ATC is growing increasingly frustrated at this, but is certainly not blameless itself, with several key questions as to their intent should Yes prevail, as yet unanswered.

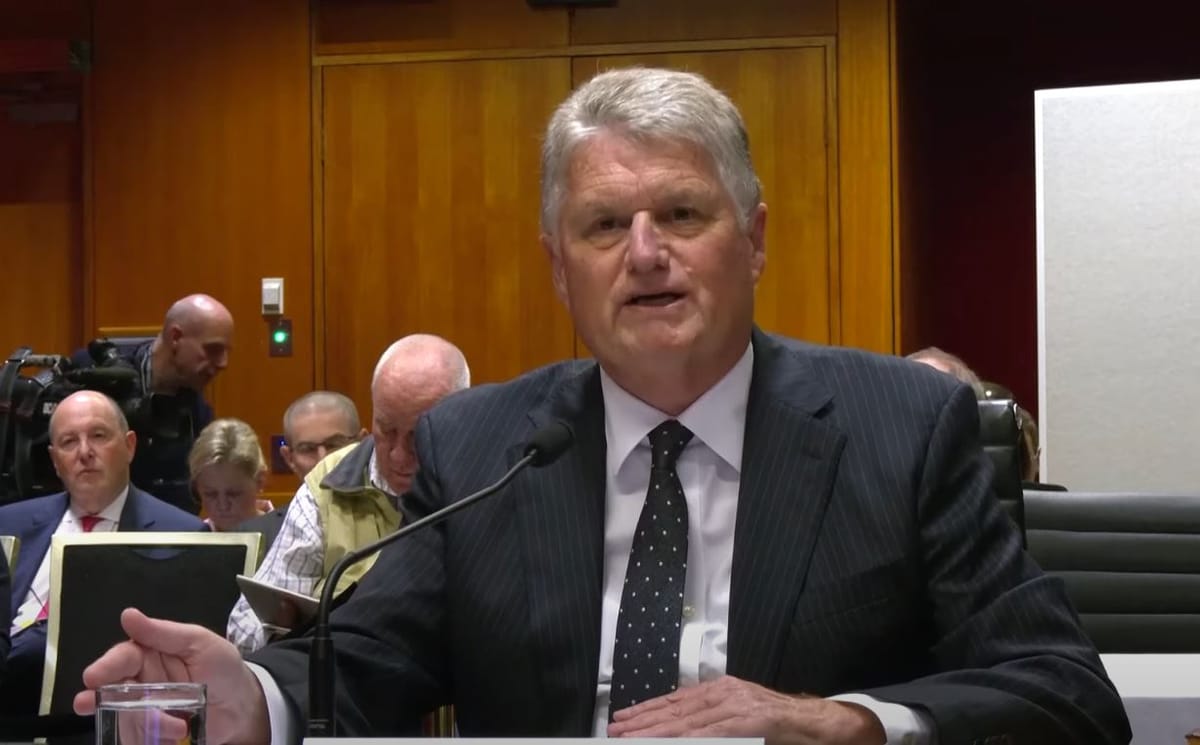

“You can't expect for the club on April the 4th to have all of the details, given it's a decade-long infrastructure project that will involve many stakeholder groups,” chairman Peter McGauran told The Straight earlier this month.

The counter-argument is that the vote shouldn’t have gone before members until these details were fleshed out. But the ATC says it is up against a government timeline regarding the construction of a Metro station. It is now or never.

So what do we know about what might happen after April 3?

The most straightforward outcome is if the members vote No. In that instance, the club will have no option but to abandon the unsolicited proposal process and find alternative ways of righting its balance sheet.

Given the board has been split on the proposal, with vice-chairman Tim Hale against the idea, while the chairman and the executive have driven it, you don’t have to be a genius to work out what might eventuate.

Whether the government might be keen to wash its hands of the idea, or pursue other options at its disposal is yet to be seen. But it is clear in its language to date that it sees more electoral value in resolving the housing crisis than saving an ageing suburban racecourse.

And that’s before you get to the most crucial question. How does the ATC survive without the Rosehill money?

It won’t have the funds to revamp either Rosehill or Warwick Farm, and will have to contemplate other methods of balancing the books.

What happens if the members vote Yes?

There are a host of possibilities here.

In fact, a straightforward Yes vote on both resolutions is no fait accompli. There is a possibility, albeit small, that members could vote Yes for resolution 1, which is effectively the sale of Rosehill to the government for no less than $5 billion, and vote No to resolution 2, which is the “that ATC will replace Rosehill Gardens with a new Group 1 quality racecourse”.

The ATC has confirmed to The Straight that it would abide by the first resolution should it pass, regardless of the outcome of the second resolution.

Assuming that doesn’t happen, and both resolutions are approved, there are a couple of further nuances to consider.

The most significant is the language of resolution 2, “that the ATC will replace Rosehill Gardens with a new Group 1 quality racecourse”.

Given part of the ATC’s proposal is to raze Warwick Farm and recreate a Group 1 quality racecourse, The Straight asked the ATC whether that would qualify Warwick Farm as a “new Group 1 quality racecourse”.

“The ATC will completely redevelop Warwick Farm, including reorientating and enlarging the course proper to create a Group 1 quality racecourse. In addition, the ATC will also purchase a completely new site developed at first for training,” it said.

It seems an important distinction.

In terms of a new site, the club has previously said it has identified at least two already, one nearby to Rosehill and one in Penrith.

However, a renewed Warwick Farm alone would satisfy the terms of the second resolution from a racing perspective.

Is a sale guaranteed?

A Yes vote doesn’t guarantee Rosehill’s sale. All it does is guarantee the price ($5 billion), the terms (payable over 15 years) and the preferred buyer (the NSW government).

The government must assess whether it has the appetite for this long-term project, given it said at the start it wouldn’t be the one to buy the site. You may recall that Premier Minns said recently he would expect negotiations over the possible acquisition of Rosehill to be “long and laborious”.

Part of that negotiation, according to what McGauran told The Straight, will be the government providing the $1.9 billion in funding for the ATC to execute its infrastructure strategy, which includes substantial revamps for Randwick and Canterbury as well as what is outlined above.

Assuming all that is agreed to, then the ATC has set out its timeline.

Training would be relocated from Rosehill by December 2028, with a key assumption being that the final USP is executed in January 2026, while racing would continue for another three years, until December 2031.

The risk is that those timelines may blow out because of delayed negotiations or regulatory approvals, something that the ATC concedes could impact costs.

Then there are questions about the possible returns from the surplus $3.1 billion generated, the majority of which is unlikely to be delivered until around a decade in - and after the building of infrastructure.

The ATC has said it will introduce a formal investment operating model to ensure appropriate investment and governance arrangements are implemented. An investment committee will deal with an external manager, who takes care of the portfolio.

This is a crucial aspect of realising value, but the ATC has not said what it expects that value to be. Independent projections based on current common investment strategies, mean it could yield north of $150 million a year for the club, or over a third of its current income. But as they say, past performance is not a guarantee of future performance.

In the end, those members who are hoping the April 3 vote will provide clarity about the future direction of the ATC may be disappointed by whatever the outcome.

This may be the most important question, but it will be far from the final one when it comes to the future of Rosehill and the ATC.