‘Largely on track’ – PointsBet stays positive despite market reaction and turnover drop

A 34 per cent year-on-year drop in turnover, plus seven per cent revisions to full year revenue and earnings has not dampened PointsBet’s optimism in its overall profitability, despite the release of its quarterly earnings report precipitating a 15 per cent fall in its share price.

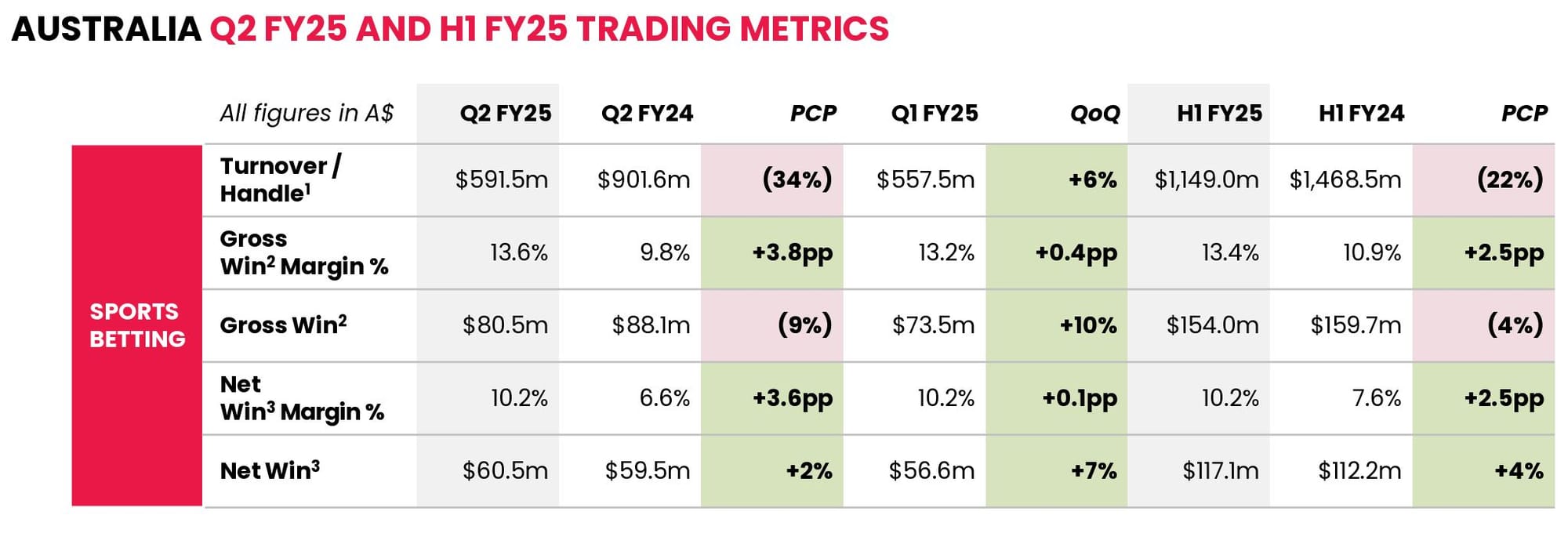

A marked change in strategy, with a focus on higher margin clients, has seen turnover in the Australian arm of the operation drop significantly from $901 million in the same quarter in 2023 to $592 million in the final three months of 2024.

However, net win across the second quarter rose by two per cent from $59.5 million to $60.5 million year on year and seven per cent quarter on quarter.

PointsBet reported it had 253,000 active clients during the quarter, up by eight per cent year-on-year, while the gross profit figure of $28.6 million was up 12.6 per cent.

The company’s full year revenue guidance had been in the $280-$290 million range, but that has been trimmed to $260-$270 million, while top-end EBITDA guidance was trimmed from $16 million to $14 million.

The ASX reacted to the announcement by dropping PointsBet’s share price from 98 cents to 80 cents, before it rebounded to 85 cents by close of play on Friday. The share price has previously risen from 50 cents in September.

Group CEO Sam Swannell said the overall trend was positive.

“I think the overall story that way the audience should take away is that gross profit is largely on track,” he told an earnings call.

“The difference is just the way we’re getting to that gross profit figure. Revenue is off a little bit, some negative variance in H1. Some VIP softness etc. but it’s nearly all been made up for in that improves gross efficiency.”

“Australia is a great case study. We keep telling people don’t just look at net win. Most of the audience has now moved on look from looking at turnover which is largely irrelevant but don’t just look at net win.

“It’s how efficiently you earn that net win. If you look at our gross profit growth rate, that’s a better reflection of how the Australian business is growing.”

Swannell said the profit profile of the company is largely unchanged but it was being delivered in a way with slightly less revenue.

He said the company would retain its current cost base, having cut marketing and generosity significantly in the past 12 months, something which has played a major role in the dramatic drop in turnover.

With continued uncertainty over whether the federal government will introduce greater restrictions on advertising, Swannell is not expecting that to have any short-term impact on the business.

“The industry continues to put forward logical solutions. I think the positive is that some of the rumoured outcomes from last year have been put on hold because of logical and reasonable feedback,” he said.

“We’d like it cleared up full stop. We think there’s a logical solution. We want it dealt with but I think there is a recognition that some of that feedback has been listened to and there are solutions there that can satisfy all needs.”

It has also emerged that the AFL intends to ramp up the product fees it charged bookmakers to bet on the league, something which could have a significant impact on a more sport-focussed bookmaker such as PointsBet.

Swannell said AFL was below NBA, but equal to range of other sports when it came to its Australian market, and there was consultation going on regarding any new fee regime.

“The racing industry is a really good example of the dynamics at play and the way the costs of a certain product can determine the way turnover can go,” he said.

“We are rational and PointsBet is the perfect example of a company that is customising its strategy around the cost model of the Australian market,

“There’s a long way to go, but I’d be surprised if there was a materially adverse outcome.”