Made in Australia, sold in America – ZeroFlucs’ journey from start-up to Caesars

Australian technology is helping drive a boom in US sports betting with a Brisbane software startup the latest firm to make an impact in the American wagering landscape.

Software provider ZeroFlucs has been acquired by Caesars Entertainment in a sale that helps underline Australia’s reputation as a world leader in wagering innovation.

The deal, for an undisclosed sum, follows the successful integration of ZeroFlucs technology into the Caesars Sportsbook platform through an existing commercial arrangement with the Brisbane-based company that was launched in 2021.

Caesars Entertainment is the largest casino and entertainment company in the US and one of the world’s most diversified gambling industry providers.

Established in Reno, Nevada in 1937, it operates a portfolio of brands including Caesars, Harrah’s, Horsehoe and Eldorado.

For ZeroFlucs founder Steve Gray, the sale to the casino colossus is the culmination of learning a lot of hard lessons to implement a global focus on a bootstrapped company that he has been able to grow organically.

It also continues Gray’s gambling industry journey, which had its genesis in software development in the UK with Compare The Market, a price comparison website best known for its quirky marketing campaign involving meerkats.

Moving to Australia 12 years ago, Gray started in the poker machine industry before working with Entain and was part of the due diligence team involved in the purchase of online bookmaker Neds.

He started ZeroFlucs certain there were international opportunities for innovation, especially in the US.

“Gambling is much more part of the national fabric in Australia,” he told The Straight.

“And so that was something that opened my eyes to quite a lot.”

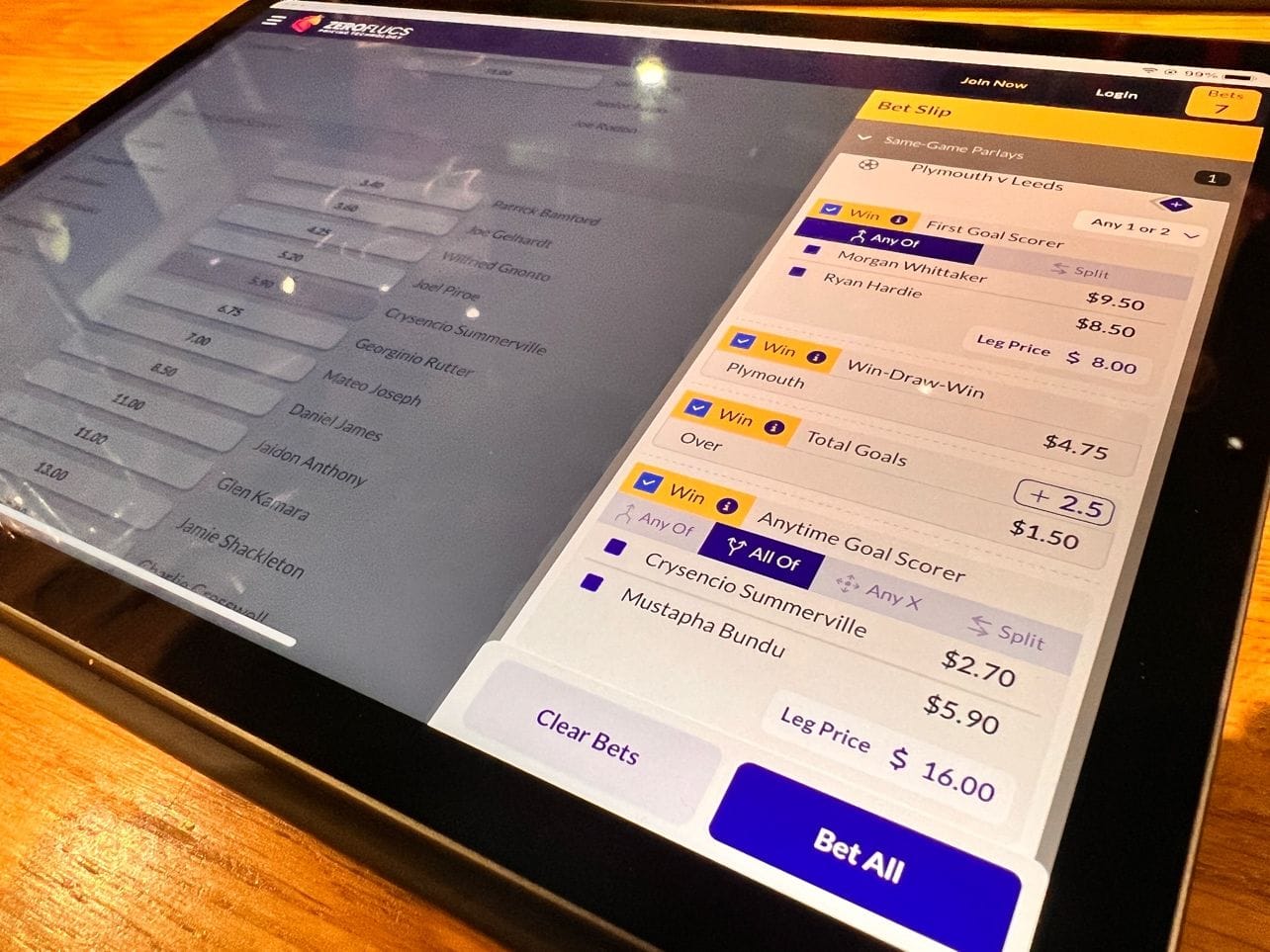

As such, the seeds for ZeroFlucs were sown using trading technology with a simulation-based pricing approach with offerings including same-game betting content and a mixing board that aggregates data from multiple feed providers.

“I had this idea I would make the product in three months but I learned very quickly that I was wrong,” Gray told The Straight.

ZeroFlucs’ breakthrough came when TopSport chief executive Tristan Merlehan was convinced that the technology could be used to offer customers same-game options.

“Tristan was one of the best customers you could have,” Gray said. “He allowed us to do some experimentation with the product.

“And we got to the point of having things go much faster because we had the models out there getting tested in the field with real customers.”

ZeroFlucs’ software enables sports betting operators to augment their pricing offerings while leveraging their own existing data sources and relationships.

This has allowed companies such as Caesars to capitalise on the explosion of sports betting, offering products that Australian customers now take for granted, such as same-game wagering options on popular American sports like the MLB and NFL.

The US sports betting industry has been in existence for six years after the Supreme Court struck down the Professional and Amateur Sports Protection Act (PASPA).

Essentially, the Act had banned sports betting in every American state except for Nevada.

But since the 2018 decision, the floodgates have opened.

Americans wagered almost $120 billion across legal sportsbooks in 2023, up from $93 billion in 2022.

Gray said he was always mindful of the potential of an untapped American market.

The ZeroFlucs chief executive, will join Caesars Digital as senior vice president of pricing initiatives.

Carly Christensen, who is also part of the ZeroFlucs management team, will be Caesars’ senior vice president of pricing technology.

“Their expertise in data science and trading technology coupled with their passion for sports makes them a perfect fit with our team as we drive to offer our customers the best sports betting product that complements our award-winning Caesars Rewards program,” Eric Hession, president of Caesars Digital said.

But Gray insists it will be business as usual for ZeroFlucs’ team of 15 people in Australia.

“We have no plans to discontinue our local operations,” he said. “We’re continuing to support all our Australian clients.”

“We absolutely respect that people took a risk on us early as a start-up.”

ZeroFlucs’ Carly Christensen and Steve Gray (Photo: ZeroFlucs)

Because Australia has an established sports wagering industry, Gray said it was only natural for American bookmakers to look beyond their shores to help expand their operations.

“With Australia obviously being a leader in that space, it certainly didn’t hurt our case in developing a relationship with Caesars,” he said.

The acquisition is a micro example of how quickly the US market is shifting.

“If you look at the evolution of the product in the US market, because of the scale, it is moving much faster than the Australian market,” Gray said.