The Next Era of Prediction Markets

We first spotlighted prediction markets in November 2024, when the U.S. election sent trading volumes parabolic. The question back then was whether these platforms could sustain engagement beyond headline events to keep markets liquid, meaningful and accurate. By February 2025, our deep-dive into CFTC-regulated Kalshi suggested they could.

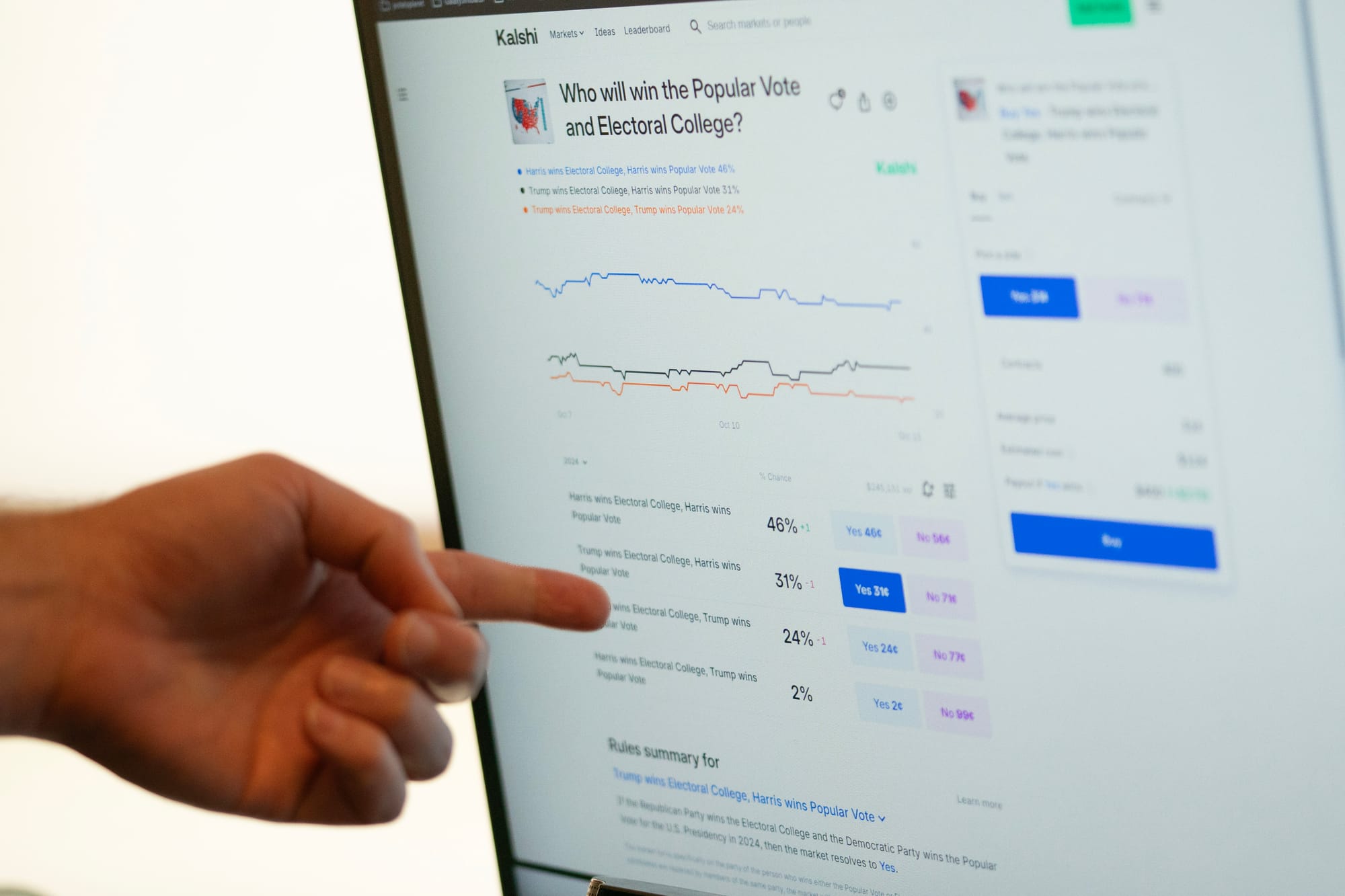

Quick Refresher: Prediction markets let users buy and sell contracts on future events – from elections and economic data to cultural moments and sport. For example, you might buy a contract on a Russia-Ukraine ceasefire in 2025 for $0.37 that pays $1 if correct. Kalshi operates as a CFTC-regulated exchange in the U.S., while Polymarket serves international users who trade with USDC on blockchain rails.

Six months on, the engine has shifted up a gear. Fresh capital has arrived. Large financial platforms Robinhood and Webull now integrate popular prediction markets directly in their apps, and professional trading firms are providing the liquidity that lets users place six-figure bets. AI integrations such as xAI’s Grok are now surfacing market odds across social media and improving the trading experience.

Billion Dollar Validation

On June 25th, Kalshi raised US$185 million at a US$2 billion valuation in a Series-C round led by Paradigm, catapulting it beyond unicorn status. The capital will fund what’s already working: expanding stockbroker integrations, encouraging participation from market makers, and launching more ‘always-on’ markets that sustain engagement.

“Prediction markets remind me of crypto 15 years ago: a new asset class on a path to trillions.” Matt Huang, Paradigm

Polymarket has matched the momentum, reportedly in the process of closing a US$200 million round at a US$1 billion valuation led by Founders Fund. In July it agreed to acquire CFTC-licensed exchange QCEX for US$112 million. That purchase provides a compliant path back into the U.S., even if it requires segregating U.S. and international liquidity. Where Kalshi spent 6 years in the regulatory trenches, Polymarket is buying existing infrastructure, an option created by Kalshi’s groundwork.

Polymarket often dominates trading volumes, especially on global events. Its international user base and broader market coverage, including wars which Kalshi does not list, arguably make it a stronger gauge of global sentiment. Yet Kalshi commands double the valuation. The premium reflects Kalshi’s current advantage in the United States, where CFTC approval unlocks broker distribution and direct access to institutional liquidity.

Distribution Advantage

When Kalshi launched on Robinhood in March 2025, over 25 million users gained instant access to prediction markets. They could speculate on sports and Fed decisions right alongside their stock trades, no additional signup required. The result: approximately one billion worth of event contracts were traded through Robinhood in Q2 (SBC).

Webull followed with S&P 500, crypto, and Fed markets, and CEO Tarek Mansour expects further broker integrations this year. Coinbase also confirmed prediction markets are on its roadmap. With over 100 million users globally, they could become a major force whether it partners or builds its own platform.

This broker-led distribution gives Kalshi a major advantage over U.S. sportsbooks. By plugging into existing brokerage accounts, it can reach tens of millions of funded users at minimal cost. FanDuel spent years building 18 million customers through state-by-state licensing, while Kalshi can achieve comparable reach almost instantly.

Kalshi recently added another hook: a 4% annual interest paid on all cash and open positions. Traditional operators struggle to compete with that, since they rely on holding customer float without paying for it.

Market Makers

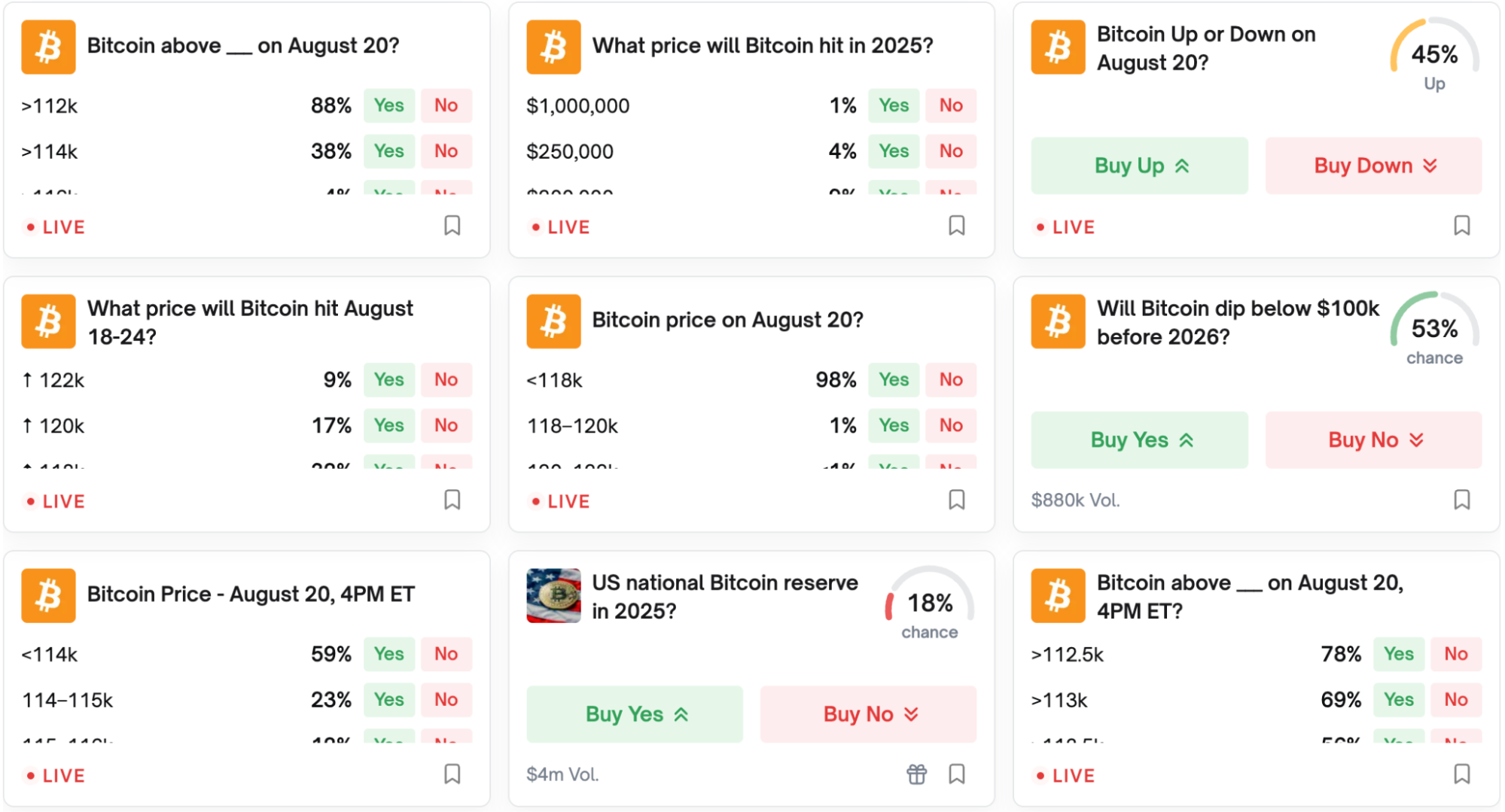

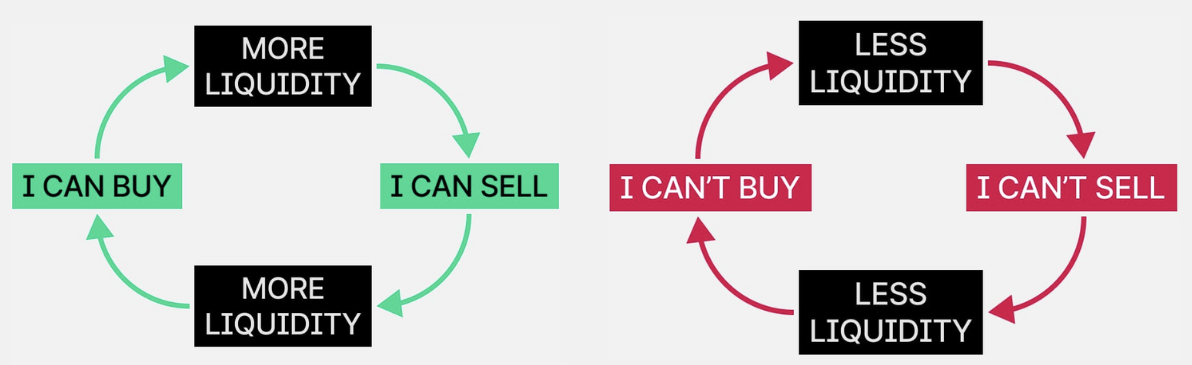

For prediction markets to fulfil their promise, they require deep liquidity. Susquehanna International Group (SIG), which handles more than a trillion dollars in ETF trades annually, established Kalshi’s first dedicated event contracts desk in April 2024. Market makers ensure instant execution and higher limits, essential for attracting professional money.

Kalshi’s Market Maker Program has since expanded to multiple firms providing 24/7 liquidity across sports, economic, and political events. Polymarket runs parallel programs that reward liquidity providers.

Yet both platforms have far to go before reaching institutional scale. Traditional derivatives like Brent Crude Futures capture geopolitical risk through billions in daily turnover. Prediction markets excel at retail engagement, and while Polymarket contracts now appear on CNBC, this growing visibility isn’t the same as sector-wide institutional participation.

Predictable Pushback

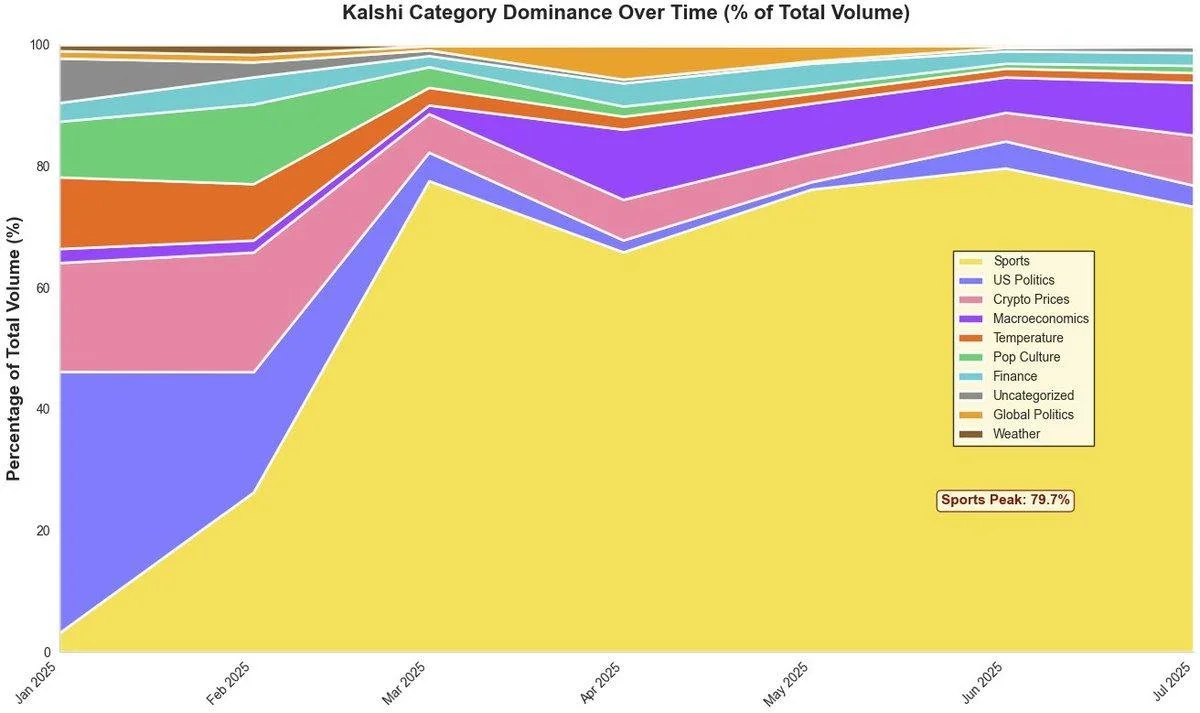

Polymarket’s international user base does not directly compete with U.S. sportsbooks. That may change once the QCEX acquisition enables domestic operations, but for now the regulatory pressure is concentrated on Kalshi, and the reason is sports. Prediction markets in elections, economics, or cultural events drew little attention. No operator has any interest in pricing up whether Taylor Swift gets engaged this year.

Sports now dominate Kalshi’s core business, averaging over 65% of trading volume since March. With the Premier League underway and the NFL season starting, these volumes will likely increase. Bettors are migrating for better prices, lower fees, and higher limits without fear of being restricted. Kalshi also benefits from operating in states where sportsbooks remain prohibited, including California and Texas, and CFTC rules allow 18-year-olds to participate compared to 21+ in most sports betting states.

Critics argue that Kalshi is offering what amounts to sports betting with no tax or licensing obligations. State gaming regulators have responded with cease-and-desist orders, investigations, and lawsuits targeting “sports event contracts”. Federal judges have largely blocked these enforcement attempts, ruling that CFTC-regulated derivatives supersede state gaming laws.

After speculation over whether traditional operators would enter the space, FanDuel this week announced a joint venture with derivatives giant CME Group to launch regulated event-based financial contracts. The products will let FanDuel users place “yes or no” bets on equity indices, commodities, crypto, and key economic indicators, with no mention of sports. The launch is slated for later this year, and attention will now shift to DraftKings to see if it follows suit.

AI Engagement Boost

AI is beginning to shape how prediction markets are used and distributed. Both platforms have partnered with xAI, and Polymarket has been coined “the official prediction market of X”. On Polymarket, users can click “generate market context” for instant AI analysis. This feature provides market history, key drivers, and potential catalysts that might move prices, making users more confident to trade.

On X, users can tag @askpolymarket or @grok to receive live probabilities and analysis. Market odds now appear directly in feeds alongside Fed policy debates or breaking news, exposing prediction markets to X’s 500+ million users. These integrations create a powerful distribution channel, turning news cycles into trading opportunities. Kalshi’s xAI partnership is expected to follow a similar path.

A Long-Term Compliment

The full version of this article is available on Waterhouse VC at the link below

Subscribe to Waterhouse VC here to receive regular updates

DISCLAIMER AND IMPORTANT NOTES

Please note the above information in relation to British Horseracing Authority, UK Gambling Commission, Regulus Partners, H2GC, IGB, Chris Fawcett, Sharp Betting, Frontier Economics, Flutter Entertainment, AK Bets, Bet365, Paddy Power, Sky Bet, and NHS, is based on publicly available information and should not be considered nor construed as financial product advice. The information provided in this document is general information only and does not constitute investment or other advice. Readers should consult and rely on professional investment advice specific to their individual circumstances.

Not for Release or Distribution in the United States of America

This material may not be released or distributed in the United States. This material does not constitute an offer to sell, or a solicitation of an offer to buy, any securities in the United States or any other jurisdiction in which such an offer would be illegal. The units in the Fund have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (the U.S. Securities Act) or the securities laws of any state or other jurisdiction of the United States. Accordingly, the units in the Fund may not be offered or sold in the United States unless they are offered and sold, directly or indirectly, in transactions exempt from, or not subject to, the registration requirements of the U.S. Securities Act and any other applicable United States state securities laws.

General Information Only

This material is for general information only and is not an offer for the purchase or sale of any financial product or service. The material has been prepared for investors who qualify as wholesale clients under sections 761G of the Corporations Act or to any other person who is not required to be given a regulated disclosure document under the Corporations Act. The material is not intended to provide you with financial or tax advice and does not take into account your objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by Sandford Capital, Waterhouse VC or any other person. To the maximum extent possible, Sandford Capital, Waterhouse VC or any other person do not accept any liability for any statement in this material.

Financial Regulatory Oversight and Administration

Waterhouse VC is an Australian Unit Trust denominated in AUD and available to wholesale institutional investors worldwide with a minimum of AUD 500,000 or USD / EUR / GBP / JPY / CHF equivalent. This material has been prepared by Waterhouse VC Pty Ltd (ABN 48 635 494 861) (‘Waterhouse VC’, ‘Trustee’, ‘us’ or ‘we’) as the Trustee of the Waterhouse VC Fund (the ‘Fund’). The Trustee is a corporate authorised representative (CAR 1278656) of Sandford Capital Pty Limited (ABN 82 600 590 887) (AFSL 461981) (Sandford Capital) and appoints Sandford Capital as its AFS licensed intermediary under s911A(2)(b) of the Corporations Act 2001 (Cth) to arrange for the offer to issue, vary or dispose of units in the Fund.

Performance

Past performance of Waterhouse VC is not a reliable indicator of future performance. We make every endeavour to ensure results are accurate. Waterhouse VC Pty Ltd does not guarantee the performance of any strategy or the return of an investor’s capital or any specific rate of return. No allowance has been made for taxation, where applicable. We encourage you to think of investing as a long-term pursuit. Waterhouse VC’s results are indicative only and subject to subsequent year end external financial review.

Copyright

Copyright © Waterhouse VC Pty Ltd ACN 635 494 861. No part of this message, or its content, may be reproduced in any form without the prior consent of Waterhouse VC.

Governing Law

These Terms and Conditions of use are governed by and are to be construed in accordance with the laws of New South Wales. By accepting these Terms and Conditions of use, you agree to the non-exclusive jurisdiction of the courts of New South Wales, Australia in respect of any proceedings concerning these Terms and Conditions of use.