Run The Numbers – Hot breeze – Two-year-old auction market continues surge

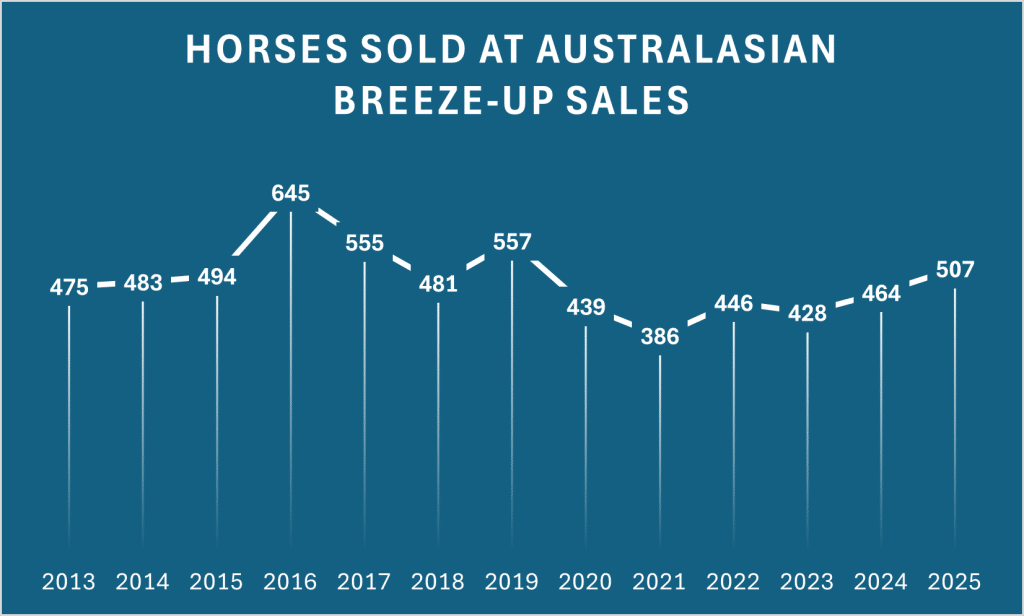

The volume of two-year-olds sold through the three Australasian breeze-up sales has reached its highest annual level since before the pandemic, as overall investment soared to record levels in 2025. Run The Numbers breaks down all the key statistics.

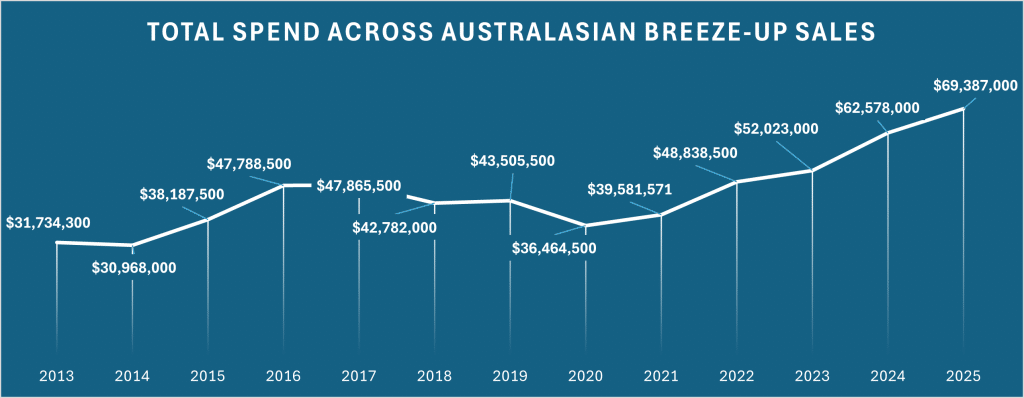

Close to $70 million was invested across Australasia’s three breeze-up sales at Karaka, Sydney and the Gold Coast in the past six weeks, a 9.2 per cent annual surge, and up 75.3 per cent over the past four years.

A total of $69.387 million was spent – assuming NZ dollar parity – across the Magic Millions Horses In Training Sale, Inglis Ready 2 Race and New Zealand Bloodstock Ready To Run Sale. That is an increase of nearly $7 million from the respective sales in 2024.

Significantly, the number of two-year-olds sold exceeded 500 – 507 to be exact – for the first time since 2019, as the format grew in demand. There were 43 extra horses sold this year than last, albeit there were an additional 105 catalogued and 40 more offered.

That total sold figure stood at a historic low of 386 in 2021, as border closures prevented free-flowing trade, but the demand for horses has increased significantly since then.

The yearly clearance rate across the three sales stood at 75.3 per cent, up from 73.3 per cent last year. The Inglis sale clearance jumped to 81 per cent this year.

But one other key statistic perhaps points to demand having reached its peak. The average price across all three sales was $136,858. That is a slight increase of 1.48 per cent on 2024 but is a step back from the respective increases of 11 per cent in each of the past two years.

The last time the average price of a two-year-old breeze-up horse fell in Australasia was in 2019, when the size of catalogues exceeded the growth in demand. It may pay the sales companies to heed that historic lesson when formulating their plans for 2026, having increased their catalogue sizes this year.

Of the $6.8 million in spending growth, $4.4 million came via the Inglis Ready 2 Race Sale, while there was a $2.4 million at the NZB Ready To Race. Inglis now has 28.5 per cent of the breeze-up market aggregate, its highest share apart from the two pandemic-impacted years of 2020 and 2021.

However, NZB is still comfortably the market leader with 59.8 per cent of the aggregate. To give some historical context, the $41.487 million grossed in 2025 surpasses what NZB did in total during those two COVID-impacted years of 2020 and 2021.

The 266 lots sold last week was the most at Karaka since 2017, with 29 more horses offered this year than last.

So where did the extra demand come from?

Buyer location statIstics can be a little misleading, especially with so much of the market influenced by Hong Kong investment, where Australasian-based agents sign for horses destined for export.

Nonetheless, it is the best guide we have as to where investment might be increasing from.

Across all three sales, investment attributed directly to Hong Kong made up 39.6 per cent of the overall spend, or $27.5 million. This was an increase of $1.49 million from last year.

Hong Kong buyers picked up five additional horses, with the average price paid jumping from $211,382 to $214,785.

There was a surge in investment from China, which in some instances was related to Hong Kong, especially at Karaka. Chinese-registered buyers spent $6.09 million across all three sales in 2025, compared to just short of $2.2 million last year.

Australian-registered investment also increased, moving to $25.4 million from $23.6 million, an increase of 7.8 per cent. Aussies bought the highest number of horses, 197, or 38.8 per cent, and contributed 36.6 per cent of the spend.

New Zealand investment slipped downward by 18 horses and $2.28 million across all three sales. The drop in spending was attributable to what happened at Karaka, particularly with Te Akau, which bought one horse last week, compared to nine last year, including the $1.65 million sale topper.

The “other areas” market share, which includes that surge in Chinese investment, was at a historic high of 15.9 per cent, or $11 million. That more than doubled from last year with an additional 39 horses purchased by buyers not registered in either Australia, New Zealand or Hong Kong.